Profitability Ratios

These rates are used to show the efficiency of the business by comparing how revenues generated from expenditure accounts have been used to meet the operational needs of the company. These ratios thus show management can make prudent ideas in operations so as to realize huge profits. Some of the profitability ratios are discussed below.

(i) Gross margin ratio is an evaluation of how best a business sells its stock within a given operating period. A high margin ratio is an indication that the business sells its supply at a high percentage profit (Carroll & Shabana, 2010). From the financial statement provided, it can be concluded that Wal-Mart Inc. is making huge profits based on its high gross margin. The trend of the margin, however, is worrying as it paints a decline in gross margin from 2013 to 2016 trading period. This could be attributed to competition and also economic recession in major segments

(ii) Gross Profit Margin Ratio is an efficiency ratio that shows how a company uses its factors of production prudently with the aim of making profits. This ratio is paramount as it demonstrates how management can manage the business's activities without affecting direct costs overhead. From the worksheet, it can be concluded that the company is managing its direct costs in a prudent manner since the ratio averages at 0.214 (David, et al, 2003). In supporting the argument, the trend is also in a declining trend showing the management efforts in maximizing profits.

Retailing mix

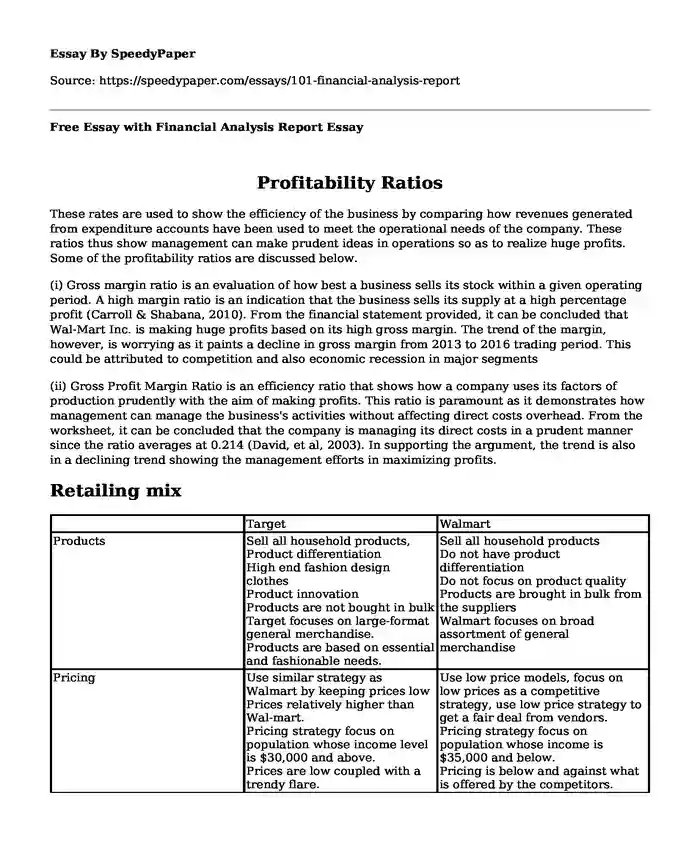

| Target | Walmart | |

| Products | Sell all household products, Product differentiation High end fashion design clothes Product innovation Products are not bought in bulk Target focuses on large-format general merchandise. Products are based on essential and fashionable needs. | Sell all household products Do not have product differentiation Do not focus on product quality Products are brought in bulk from the suppliers Walmart focuses on broad assortment of general merchandise |

| Pricing | Use similar strategy as Walmart by keeping prices low Prices relatively higher than Wal-mart. Pricing strategy focus on population whose income level is $30,000 and above. Prices are low coupled with a trendy flare. | Use low price models, focus on low prices as a competitive strategy, use low price strategy to get a fair deal from vendors. Pricing strategy focus on population whose income is $35,000 and below. Pricing is below and against what is offered by the competitors. |

| Place | High end stores placed across the United States. The products are clean and offer a good shopping experience | Not high end stores. Big stores spread across the United States. Do not guarantee the best shopping experience. Stores are located in rural and urban places. |

| Promotion | Target young customers, affluent and middle-class population Price products based on quality and shopping experience Use appealing logo and brands Vibrant marketing using television, print media, social media, and sponsorships. Use online platforms for marketing. | Target old, poor and middle class population Prices are low to maintain high volume of sales Use television and print, audiovisual media, social media Invest heavily in brand recognition. Relies on personal selling. |

| Personnel | Highly trained personnel to offer best customer service. Glooming of personnel in Target is a corporate culture. | Not highly trained personnel and does not require qualifications in customer service. Walmart personnel are less groomed and only wear the usual staff uniform. |

| Presentation | Clean and well-arranged stores for good customer experience. Target stores are appealing with good and bright lighting. The layout and shelves are well arranged. The use of fetching displays and well aligned aisles | Not consistent with store arrangement and organization. Lighting at Walmart is poorly lit and the alleys are dim with products layout not well arranged. Shelves and products aligned in aisles are in haphazard and random manner. |

The cost of capital

This section will discuss the interventions that need to be recommended while making an investment decision. These decisions will be geared towards generating more revenues which increase the inventory in the respective company. Investor investments in a certain corporation are monitored using investor ratios (Ball, 2001). Investor ratios also show a company’s economic performance, as well as its ability to provide some good returns to investments. The ratios are very crucial in helping the investors make informed decisions in regard to investing in a certain company (Ward, 2011)

Investor Analysis Ratios

Despite there being signs of dawdling growth in Wal-Mart’s profits, it is important to note that its profitability level is fine, considering that the company is still recovering from the latest financial crisis. Although the growth rate of the company is slow, it has been registering some improvement every year. As indicated in the analysis above, the performance and growth of Wal-Mart is superior to that of Target Corporation.

Net Present Value

Net present value (NPV) is used to make investment decisions based on the cash flows of the company. The decision will be made to adopt the project if the NPV value is positive. NPV also helps in making decisions regarding the internal rate of Return (IRR).

| Year | cash inflows | Pv at 20% | Present value |

| USD | |||

| 1 | 180,000 | 0.8333 | 149,994 |

| 2 | 125,000 | 0.6944 | 86,800 |

| 3 | 100,000 | 0.5787 | 57,870 |

| 4 | 95,000 | 0.4823 | 45,818.5 |

| 5 | 65,000 | 0.4019 | 26,123.5 |

| Total present value | 366,606 | ||

| Less Initial Investment | 400,000 | ||

| Net present value | -33,394 |

The IRR lies between 10 % and 20 %. But we can get much closer to the precise answer by using arithmetic as shown below.

IRR = 10% + (10 x 47,311.5/80705.5)

IRR = 10 + (10 x 0.5862)

IRR = 15.862%

(ii) Net present value

| Year | cash inflows | Pv at 10% | Present value |

| USD | |||

| 1 | 180,000 | 0.9091 | 163,638 |

| 2 | 125,000 | 0.8264 | 103,300 |

| 3 | 100,000 | 0.7513 | 75,130 |

| 4 | 95,000 | 0.683 | 64,885 |

| 5 | 65,000 | 0.6209 | 40,358.5 |

| Total present value | 447,311.5 | ||

| Less Initial Investment | 400,000 | ||

| Net present value | 47,311.5 |

Accept the project if NPV is greater than 0.

Financial Analysis Discussion

The degree of the financial leverage of at Wal-Mart is rather stagnant. The profitability ratios, for example, failed to change significantly between the years 2014 and 2016. Secondly, the earnings per share for the shareholders registered only a slight increase from 4.47 in the year 2011 to 5.02 in the year 2013. At the same time, Price/earnings per ratio improved from 12.54 to 13.93. Nevertheless, the corporation’s Percentage of Earnings Retained reduced from 72% to 68% in the same financial period. It is important to note that Wal-Mart’s book value per share, dividend yield and dividend payout increased, on the other hand. As a matter of fact, the growth rate in these ratios is creditably high. The price to earnings ratio is on the rise. This may be used as a yardstick for investors. It is a demonstration that there is hope for the investors.

Comparison with Target Corporation

Although Wal-Mart and Target Corporation have almost values in terms of degree of financial leverage, earnings per share and price ratio, Wal-Mart performs better than the competitor does. Despite this, there are few differences between the two companies because the growth trend is relatively similar (Ball, 2001). This is an indication that the industry is growing at a commendable rate.

Comparison with the Industry

As indicated above, the retail industry in the United States has experienced growth since 2010. While Wal-Mart grows by 0.24%, the industry has an overall growth of about 1.4%. This is an indication that the future of investors in the company and the industry are good.

Financial Analysis Summary

In summary, Target Corporation is not the best choice for long-term investment as compared to Wal-Mart Inc. This is because despite the company’s rapid success, it has faced various challenges; most notably public scrutiny for breaching confidentiality of customer’s data and failure to establish itself in the Canadian Market. Another major threat facing the company is competition from its main rival, the Wal-Mart Inc. The problem is that the company does not seem to have come up with the best strategy to overcome this competition. As noted above, the company does not also apply sound financial principles; and this is a bad precedence for investors.

Wal-Mart Inc., on the other hand, provides the best opportunity for investors. The ability of the company to meet its liabilities using its assets indicates its power to maintain considerable growth in the projected future. Basing on the financial information analyzed above, it is also important to note that Wal-Mart Inc. adheres to sound financial principles; hence, remains the superior choice for investors who wish to reap highly from their investments. As shown by the investors’ ratios analyses, Wal-Mart Inc. offer investors an excellent investment opportunity since the ratios are a sign of a bright future. It is, therefore, imperative that investors consider financial principles before embarking on any investment.

Cite this page

Free Essay with Financial Analysis Report. (2018, Feb 28). Retrieved from https://speedypaper.net/essays/101-financial-analysis-report

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay with Meta-analysis of Fluid and Electrolyte Balance

- Literary Essay Sample: Victor Hugo of Les Miserable

- Should teachers be able to carry concealed weapons on campus?

- Free Essay: Public Transportation - A Necessary Expense or a Waste of Public Money?

- Essay Example on the 1920 Era as Portrayed in The Great Gatsby Novel

- Paper Example: China and the Greenhouse Gases

- Paper Example. Review of Research Articles

Popular categories