| Type of paper: | Essay |

| Categories: | Starbucks Tesla Risk management Financial management |

| Pages: | 3 |

| Wordcount: | 630 words |

The portfolio consists of five assets SPY Fund, Tesla, Apple, Starbucks, and 10 Year Bill. Tesla, Apple, and Starbucks are stocks trading on the NASDAQ stock exchange. 10 Year bill is a bond while SPY is an exchange-traded fund. Thus, the portfolio is well-diversified thereby eliminating or reducing the systematic risk associated with each asset.

Performance of the Portfolio

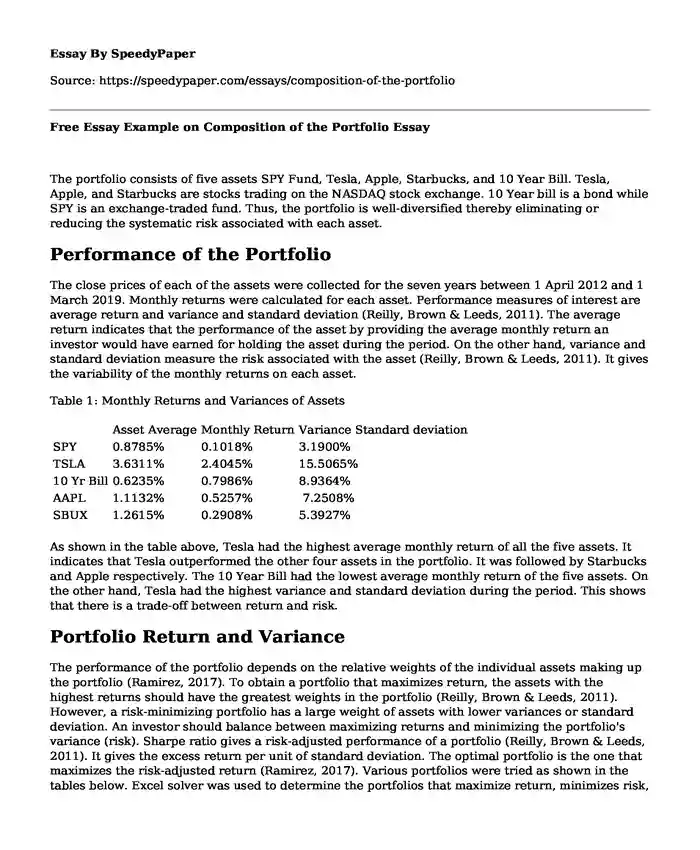

The close prices of each of the assets were collected for the seven years between 1 April 2012 and 1 March 2019. Monthly returns were calculated for each asset. Performance measures of interest are average return and variance and standard deviation (Reilly, Brown & Leeds, 2011). The average return indicates that the performance of the asset by providing the average monthly return an investor would have earned for holding the asset during the period. On the other hand, variance and standard deviation measure the risk associated with the asset (Reilly, Brown & Leeds, 2011). It gives the variability of the monthly returns on each asset.

Table 1: Monthly Returns and Variances of Assets

| Asset Average | Monthly Return | Variance Standard deviation | |

| SPY | 0.8785% | 0.1018% | 3.1900% |

| TSLA | 3.6311% | 2.4045% | 15.5065% |

| 10 Yr Bill | 0.6235% | 0.7986% | 8.9364% |

| AAPL | 1.1132% | 0.5257% | 7.2508% |

| SBUX | 1.2615% | 0.2908% | 5.3927% |

As shown in the table above, Tesla had the highest average monthly return of all the five assets. It indicates that Tesla outperformed the other four assets in the portfolio. It was followed by Starbucks and Apple respectively. The 10 Year Bill had the lowest average monthly return of the five assets. On the other hand, Tesla had the highest variance and standard deviation during the period. This shows that there is a trade-off between return and risk.

Portfolio Return and Variance

The performance of the portfolio depends on the relative weights of the individual assets making up the portfolio (Ramirez, 2017). To obtain a portfolio that maximizes return, the assets with the highest returns should have the greatest weights in the portfolio (Reilly, Brown & Leeds, 2011). However, a risk-minimizing portfolio has a large weight of assets with lower variances or standard deviation. An investor should balance between maximizing returns and minimizing the portfolio's variance (risk). Sharpe ratio gives a risk-adjusted performance of a portfolio (Reilly, Brown & Leeds, 2011). It gives the excess return per unit of standard deviation. The optimal portfolio is the one that maximizes the risk-adjusted return (Ramirez, 2017). Various portfolios were tried as shown in the tables below. Excel solver was used to determine the portfolios that maximize return, minimizes risk, and the optimal portfolio (maximizes Sharpe ratio).

Table 2: Portfolio Weights

| Base Portfolio | Min Risk Portfolio | Maximum Return Portfolio | Optimal Portfolio | |

| SPY | 20.00% | 80.53% | 0.00% | 54.66% |

| TSLA | 20.00% | 1.10% | 100.00% | 12.54% |

| 10 Yr Bill | 20.00% | 2.69% | 0.00% | 0.00% |

| AAPL | 20.00% | 0.10% | 0.00% | 5.54% |

| SBUX | 20.00% | 15.58% | 0.00% | 27.26% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

Table 3: Portfolio Returns and Variance

| Base Portfolio | Min Risk Portfolio | Max Return Portfolio | Optimal Portfolio | |

| Average Return | 1.5016% | 0.9618% | 3.6311% | 1.3411% |

| Variance | 0.2313% | 0.0935% | 2.3755% | 0.1295% |

| Standard Deviation | 4.8089% | 3.0575% | 15.4128% | 3.5980% |

| Sharpe Ratio | 31.2245% | 31.4563% | 23.5590% | 37.2736% |

The base portfolio assigns equal weights to each of the five assets. As shown in Table 3, the average return on the base portfolio is 1.506% with a variance of 0.2313%. Its Sharpe ratio is 31.2245%. The minimum risk portfolio minimizes the portfolio's variance. As indicated in Table 2, SPY has the highest weight in the minimum risk portfolio contains (80%) followed by Starbucks at 15% with the other assets having a total weight of about 5%. The average return of this portfolio is 0.9618% with a variance of 0.0935% and a Sharpe ratio of 31.4563%. This portfolio has the lowest average return of all the possible portfolios. The maximum return portfolio would consist of Tesla's stock only. Its return is 3.6311% with a variance of 15.4128% making it the riskiest portfolio of all the possible portfolios.

The optimal portfolio maximizes the Sharpe ratio thus giving the highest risk-adjusted performance. It consists of four assets as it excludes the 10 Year Bill as shown in Table 4. It has the highest Sharpe ratio and the second lowest variance.

References

Ramirez, E. (2017). Financial Management. Hauppauge: Nova Science Publishers, Inc.

Reilly, F., Brown, K., & Leeds, S. (2011). Investment analysis & portfolio management. Cengage Learning.

Cite this page

Free Essay Example on Composition of the Portfolio. (2022, Dec 15). Retrieved from https://speedypaper.net/essays/composition-of-the-portfolio

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Sample on Business Incubator Practice

- Historical Essay Sample: Goods and the European Exploration

- HR Value Adding Chain - Free Essay Example

- A Workaholic - Definition Essay Example

- Management Essay Example: Organizational Framework

- Essay Example on "What Is Intersectionality and Why Do I Need It" by Ijeoma Oluo

- Essay Sample: Retribution and Justice Depictions in The Film "A Time to Kill"

Popular categories