| Type of paper: | Essay |

| Categories: | Finance Business Airline industry |

| Pages: | 4 |

| Wordcount: | 861 words |

Profitability

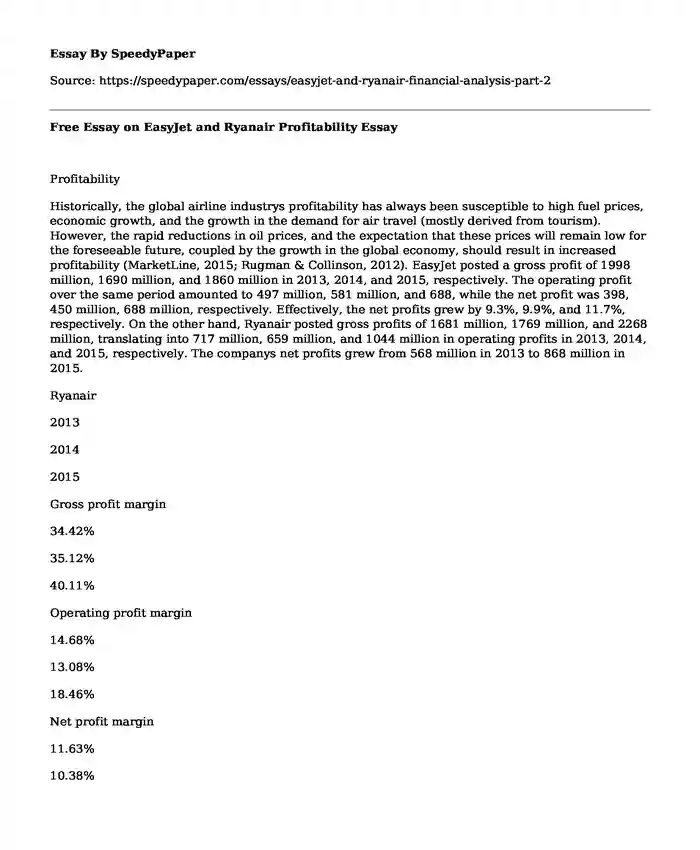

Historically, the global airline industrys profitability has always been susceptible to high fuel prices, economic growth, and the growth in the demand for air travel (mostly derived from tourism). However, the rapid reductions in oil prices, and the expectation that these prices will remain low for the foreseeable future, coupled by the growth in the global economy, should result in increased profitability (MarketLine, 2015; Rugman & Collinson, 2012). EasyJet posted a gross profit of 1998 million, 1690 million, and 1860 million in 2013, 2014, and 2015, respectively. The operating profit over the same period amounted to 497 million, 581 million, and 688, while the net profit was 398, 450 million, 688 million, respectively. Effectively, the net profits grew by 9.3%, 9.9%, and 11.7%, respectively. On the other hand, Ryanair posted gross profits of 1681 million, 1769 million, and 2268 million, translating into 717 million, 659 million, and 1044 million in operating profits in 2013, 2014, and 2015, respectively. The companys net profits grew from 568 million in 2013 to 868 million in 2015.

Ryanair

2013

2014

2015

Gross profit margin

34.42%

35.12%

40.11%

Operating profit margin

14.68%

13.08%

18.46%

Net profit margin

11.63%

10.38%

15.35%

Cash flow margin

20.95%

20.75%

29.9%

Return on assets (ROA)

6.35%

5.94%

or Return on investment (ROI)

Return on equity (ROE)

17.35%

15.92%

Cash return on assets

11.44%

11.86%

EasyJet

2013

2014

2015

Gross profit margin

46.92%

37.33%

39.69%

Operating profit margin

11.67%

12.83%

14.68%

Net profit margin

9.35%

9.94%

11.69%

Cash flow margin

14.47%

8.70%

13.00%

Return on assets (ROA)

9.02%

10.04%

or Return on investment (ROI)

Return on equity (ROE)

19.73%

20.72%

Cash return on assets

13.96%

8.79%

Figure 4: Profitability ratios

The profitability ratios point to generally low profitability, with Ryanair seeing a steady growth, while EasyJet seems to be barely breaking even. The formers net profit margin, which shows the proportion of cost of sales, tax, operational expenses and other expenses/costs to the total revenues, rose from 9.35% in 2013 to 11.69% in 2015. The same is reflected in the gross profit margin, operating profit margin, and net profit margin. There is also an improvement in the cash flow margin, from 20.95% in 2013 to 29.9% in 2015. The cash flow margin assesses how efficiently the company converts its sales to liquid cash i.e. the money generated from the firms core operations per unit of sales. Effectively, this ratio points to the same reality apparent in the liquidity ratios, to the effect that the company generates substantial levels of liquid assets from its operations. Unlike the net profit margin that includes transactions in which cash is not transferred (e.g. depreciation) or EBITDA, the cash flow margin is helpful because it assesses whether the firm can generate enough cash from its core operations.

On the other hand, EasyJet also remains profitable but has struggled with falling profit margins over the past three years. The gross profit margin fell from 46% in 2013 to 39.69% in 2015, even as the companys operating profit margin and net profit margin rose slightly from 11.67% to 14.68%, and 9.35% and 11.69%, in 2013 and 2014, respectively. The companys ability to meet its cash needs from its operations also reduced as shown by the reduction in the cash flow margin from 14.47% in 2013 to 13.0% in 2015. Despite the reduction, the rates remain acceptably high for both companies. With the return on investments/assets being 5-20%, growth in the airline industry should lead to better utilization of the available assets, and increased profitability (Rugman & Collinson, 2012; Yip & Hult, 2011).

Leverage Ratios

The capital structure ratios compare funds provided by equity owners and funds from creditors, including the determination of the risk to creditors due to the firms capital structure. It is important that both EasyJet and Ryanair ensure they maintain a robust capital structure, enough to take advantage of potentially lucrative opportunities that may present as a consequence of the growth in the industry (EasyJet Plc., 2015; Yip & Hult, 2011).

2013

EasyJet

Ryanair

Debt ratio

54.28%

63.41%

Long-term debt to total capitalization

16.76%

49.64%

Debt to equity

1.19

1.73

Financial leverage (FL)

2.19

2.73

Times interest earned

31.06

7.24

Cash interest coverage

0

0

Fixed charge coverage

31.06

7.24

Cash flow adequacy

0.92

0.88

2014

EasyJet

Ryanair

Debt ratio

51.54%

62.71%

Long-term debt to total capitalization

12.10%

45.16%

Debt to equity

1.06

1.68

Financial leverage (FL)

2.06

2.68

Fixed charge coverage

52.82

7.94

Cash flow adequacy

0.74

1.16

Figure 5: Leverage Ratios

The debt ratio and debt-to-equity ratio measure the firms financial leverage. Figure 5 shows several solvency ratios, which show that both companies leverage is average. This means that shareholders equity and interest-bearing debt as well as other liabilities represent a fairly acceptable portion of these two airlines assets. The long-term debt to total capitalization ratio assesses the ability of the firms to meet their long-term debt obligations. EasyJets value is 16%, but falls to 12%, while Ryanairs is 49% in 2013, but falls to 45% in 2014. The average values for long-term debt-to-capitalization and debt-to-equity ratio point to average or even low long-term debt, including capital lease obligations, is less than half the size of the capitalization. The financial leverage is just over 2.06 for EasyJet and 2.68 for Ryanair, which means that these companies total debt relative to the shareholders equity is high, and also that they both have been fairly aggressive in financing their growth with debt. This may point to possible volatility in earnings, but it must be noted that the airline industry is characterized by low or even negative shareholders equity, and hence the general expectation that these ratios would be relatively high. The fixed charge coverage, which includes rental and interest expenses, shows that both EasyJet and Ryanair have been able to generate enough earnings to take care of these expenses.

Cite this page

Free Essay on EasyJet and Ryanair Profitability. (2017, Aug 05). Retrieved from https://speedypaper.net/essays/easyjet-and-ryanair-financial-analysis-part-2

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Sample: The Most Difficult Academic Problem I Have Faced

- What Is The Iliad About - Get an Answer from Our Free Essay Example

- Nutrition Essay Sample

- Essay Sample on Criminal Justice Ethics

- Subaru and Suzuki: SPPS Quantitative Assignment Essay Sample

- Essay Example: Conjoint Analysis, Cluster Analysis, and Multidimensional Scaling

- Free Essay - "The Big Question"

Popular categories