| Type of paper: | Essay |

| Categories: | Company Management Finance Financial management |

| Pages: | 6 |

| Wordcount: | 1492 words |

Company Background: Nesma Traders is a group of companies that was established in 1979. It has its headquarters in Jeddah. Its headed by Sheikh Ali Abdulrahman Al-Turki who is a Saudi Arabian Entrepreneur. The company since its inception has grown from a small company to now running a chain of businesses. Owing to the fact that the company mainly deals with airlines, engineering, and construction, logistics, manufacturing, communications, recycling and supplying of innovative products have made the company to have a larger market share (Ahmed Heshmat, 2012).

The portfolio of Nesma Traders is highly rated and can be rated 8/10. This is because the portfolio provides all the relevant information to their customers. It is always updated, and customers can make informed decisions about the company before they trade with them.

Opportunities and challenges: One of the challenges it faces is the stiff competition from its rivals (Heshmat, 2012). It has high chances of capturing a wider market because of its high quality productivity.

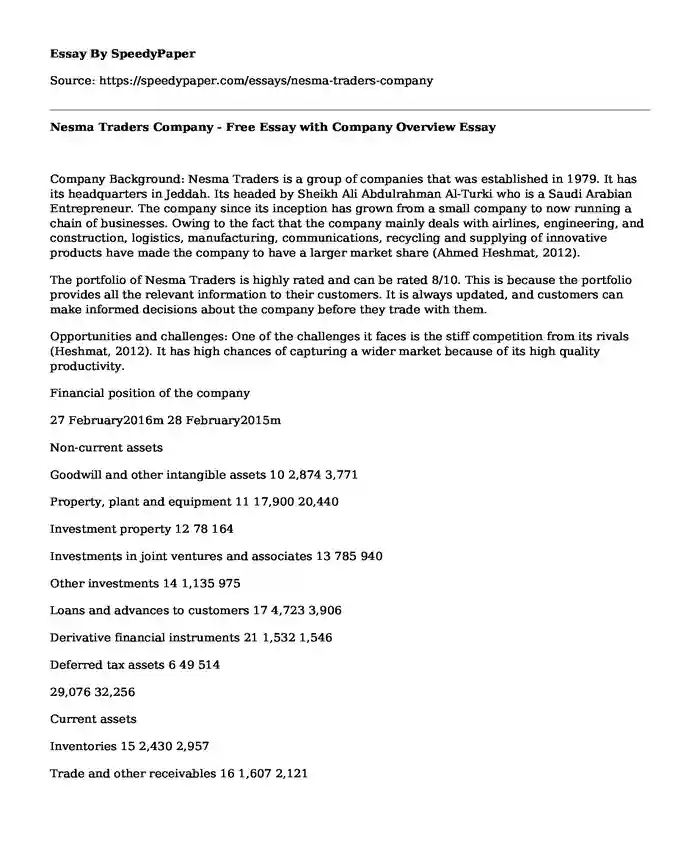

Financial position of the company

27 February2016m 28 February2015m

Non-current assets

Goodwill and other intangible assets 10 2,874 3,771

Property, plant and equipment 11 17,900 20,440

Investment property 12 78 164

Investments in joint ventures and associates 13 785 940

Other investments 14 1,135 975

Loans and advances to customers 17 4,723 3,906

Derivative financial instruments 21 1,532 1,546

Deferred tax assets 6 49 514

29,076 32,256

Current assets

Inventories 15 2,430 2,957

Trade and other receivables 16 1,607 2,121

Loans and advances to customers 17 3,819 3,814

Derivative financial instruments 21 176 153

Current tax assets 15 16

Short-term investments 18 3,463 593

Cash and cash equivalents 18 3,082 2,165

14,592 11,819

Assets of the disposal groups and non-current assets classified as held for sale 7 236 139

14,828 11,958

Current liabilities

Trade and other payables 19 (8,568) (9,922)

Borrowings 20 (2,826) (2,008)

Derivative financial instruments and other liabilities 21 (62) (89)

Customer deposits and deposits from banks 23 (7,479) (7,020)

Current tax liabilities 6 (419) (95)

Provisions 24 (360) (671)

(19,714) (19,805)

Liabilities of the disposal groups classified as held for sale 7 (5)

Net current liabilities (4,886) (7,852)

Non-current liabilities

Borrowings 20 (10,711) (10,651)

Derivative financial instruments and other liabilities 21 (889) (946)

Post-employment benefit obligations 26 (3,175) (4,842)

Deferred tax liabilities 6 (135) (199)

Provisions 24 (664) (695)

(15,574) (17,333)

Net assets 8,616 7,071

Equity

Share capital 27 407 406

Share premium 5,095 5,094

All other reserves (141) (414)

Retained earnings 3,265 1,985

Equity attributable to owners of the parent 8,626 7,071

Non-controlling interests (10)

Total equity 8,616 7,071

Al Fozan Group

Company background: Al Fozan Building Company is a group of companies and is one of the largest importers of building materials. The main products include steel, wood, insulation material and aluminum. One of its main competitors is Nesma Trading Company (Bassioni, 2014). It places a lot of precedence on. Its business line includes real estate, retail, manufacturing, and trading.

Portfolio: The portfolio can be rated 81% because of the privacy in its portfolio. The information in the portfolio is well arranged.

Opportunities and challenges: It faces competition from Nesma Holdings Company. This is a challenge as it involves sharing of the market and constantly devising better strategies to overpower their main rival. The opportunity the firm has is its good technology that can be utilized to have a larger market share. The companys financial position is as follows;

For the year ended 31 December 2015

Revenues 2015 SR 2014 SR

Fee income from rendering services 89,592,067 48,788,391

Gains from held for trading investment-net 2,522,223 15,076,172

Gains on sale of available for sale investments 1, 351,380 4,863,413

Dividend income 5,187,766 8,386,228

TOTAL REVENUES 98,653,436 77,114,204

(Power, 2015)

Section 2

Key success factors approach in Nesma Holding Company

Diagram

Explanation

One of the approaches used by the companys management was the key success factors approach. The first success factor that Nesma traders implemented was engagement. It involves all the stakeholders and staff throughout the company has increased their commitment and morale to the end plan (Lawrimore, 2011). Furthermore, they have been able to gain more insights into the challenges, issues, concerns, and opportunities that may not have been fully understood or known by the management. The second success factor that the management is aligned to gain a competitive advantage was its culture (Lukac, 2005). The management ensured that they aligned their culture to be congruent with their vision and missions. The third success factor that the company embarked on was on innovation. To diversified their products range in the trade industry to gain a larger market share. To drive innovation, they always ensured they hired the best talent in the labor market. Similarly, the communication has played an integral role in facilitating the strategic planning process. They embraced both top down and bottom up communication approach. Finally, they also ensured effective project management by identifying projects to be implemented to ensure the implementation of each strategy.

Section 3

Profit Pool Map for Al Fozan Group

Diagram

Exaplanation

Profit Pool Map is an approach that best suits Al Fozan Group of Companies. This is because the group focuses on increasing the net profit that is earned by the company and pays less attention to the revenue growth. The management should identify all the activities within the organization which are generating disproportionately small or large profit shares. This normally opens up a window onto the underlying structure of the industry. The well-trained management of the Al Fozan Group of Companies can learn from this and identify the economic and competitive forces that are great factors in determining the distribution of profits. Profit pool map, therefore, can assist the management of Al Fozan Building Material Company in having a strong foundation for strategic thinking.

This approach entails some complexities which are in some segments of the value chain which have a deeper pool compared to others. To reduce the competition that the company is facing, the approach will require that the management identifies new sources of profit. They will also be able to categorize their role in the value chain and also to refocus on their traditional sources of profit as well as their strategies applied when making pricing, product and operational decisions.

Section 4

Competitors analysis approach to Unilever Company

Diagram

Explanation

The company uses the competitive strategy approach in all its markets. It analyses the five major factors that shape the industry. They emphasize on the relative power of its suppliers. It ensures it has reputable and consistent suppliers that offer the right quality and quantity of products needed (Aaker, 2014). They pay suppliers promptly. To avert the challenge of competitive products, they have diversified their products and producing a wide range of products. Through this, they have managed to overcome the challenge of the threat of substitute products as well as new entrants. They are considered market leaders and have experienced less rivalry in the industry (Fleisher & Bensoussan, 2015).

Section 5

The Porters 5 Forces for Ice Cream Company

The Ice Cream Company

Diagram

lefttop

Explanation

Considering the operation of the Ice Cream since its inception, the Porters five forces can be well applied in its day to day operation on its success. Using the first force which is the suppliers power, the management can find out how easy it is for the suppliers to scale up their prices. To boost this force, the company should reduce the number of suppliers for each key input as well as the uniqueness of the various kinds of ice creams they produce. Reducing the number of suppliers will increase the powerfulness of the suppliers (Porter, 2008). Buyer power is also another power that will help the management of the company. The management will have to reduce the prices of the ice creams they sell so that they can reduce the level of competition with their close rivals. They will, in turn, have control over the buyers which are the market. In dealing with the competitive rivalry and threats of substitution, the management of the company should have control over the suppliers and the buyers so that the competitive nature of the market may not work to their disadvantage. The management should also ensure that the products they release to the market are of the higher quality so that they can capture a wider market. Through this, they would have minimized the threats of new entry of another firm in the industry.The balance sheet for the Ice cream Company is;

Reference

Aaker, D. A. (2014). Strategic market management.

Ahmed Heshmat, N. (2012). Non-professional investors' behavior: an empirical study of female Saudi investors.International Journal of Commerce and Management, 22(1), 75-90.

Bassioni, H. A., Price, A. D., & Hassan, T. M. (2014). Performance measurement in construction. Journal of management in engineering, 20(2), 42-50.

Fandel, G., Backes-Gellner, U., Schluter, M., & Staufenbiel, J. E. (2004). Modern Concepts of the Theory of the Firm: Managing Enterprises of the New Economy. Berlin, Heidelberg: Springer Berlin Heidelberg.

Fleisher, C. S., & Bensoussan, B. E. (2015). Business and Competitive Analysis: Effective Application of New and Classic Methods.

Heshmat, N. A. (2012). Analysis of the Capital Asset Pricing Model in the Saudi Stock Market. International Journal of Management, 29(2), 504.

Lawrimore, E. W. (2011). The five key success factors A powerful system for total business success. Charlotte, N.C: Lawrimore Communications.

Lukac, D. (2005). Key success factors for Foreign Direct Investment (FDI): The case of FDI in Western Balkan. Hamburg: Diplomica-Verl.

McLoughlin, D., & Aaker, D. A. (2010). Strategic market management: Global perspectives. Hoboken, N.J: Wiley.

Porter, M. E. (2008). The five competitive forces that shape strategy.

Power, M. (2015). Making things auditable. Accounting, organizations and society, 21(2), 289-315.

Schafer, L. H., & Josef Eul Verlag GmbH. (2016). Employees as Key Success Factors for Sustainability Strategies?: An Empirical Study of the Influence of Human Resource Development.

Cite this page

Nesma Traders Company - Free Essay with Company Overview. (2019, Oct 01). Retrieved from https://speedypaper.net/essays/nesma-traders-company

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Marketing Plan Essay Example

- Float System Research: Free Essay on Capital Controls in Malaysia

- Free Essay Describing the Assessment Strategy for Children and Families Module

- HLS503 SLP 2 Assignment

- Women and Imprisonment within Jane Eyre, Essay Sample

- Ethics and Professionalism Essay Sample

- Paper Example on Behavioral Issues in Children: Anthony Case Study

Popular categories