| Type of paper: | Essay |

| Categories: | Company Management Finance Financial management |

| Pages: | 5 |

| Wordcount: | 1129 words |

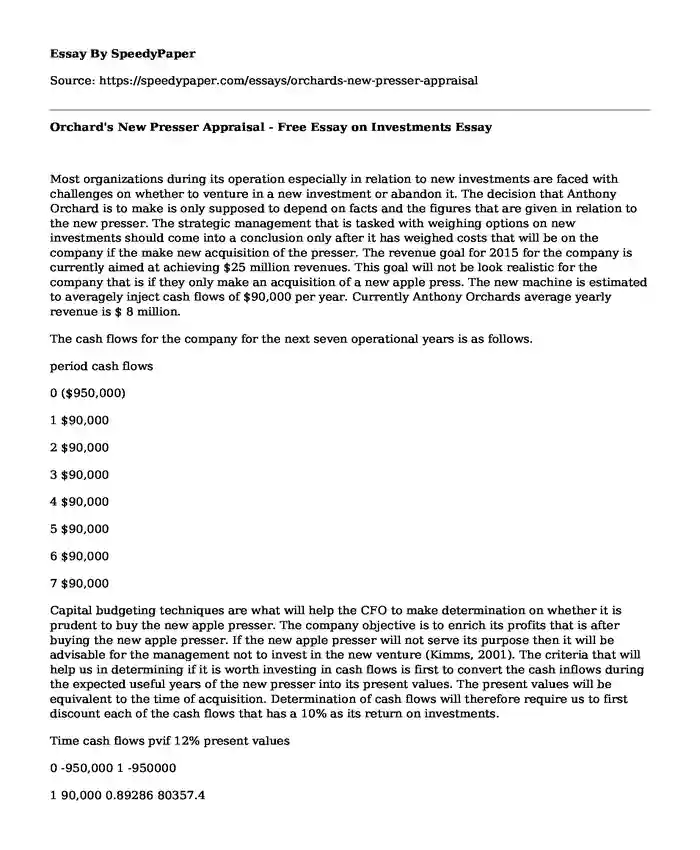

Most organizations during its operation especially in relation to new investments are faced with challenges on whether to venture in a new investment or abandon it. The decision that Anthony Orchard is to make is only supposed to depend on facts and the figures that are given in relation to the new presser. The strategic management that is tasked with weighing options on new investments should come into a conclusion only after it has weighed costs that will be on the company if the make new acquisition of the presser. The revenue goal for 2015 for the company is currently aimed at achieving $25 million revenues. This goal will not be look realistic for the company that is if they only make an acquisition of a new apple press. The new machine is estimated to averagely inject cash flows of $90,000 per year. Currently Anthony Orchards average yearly revenue is $ 8 million.

The cash flows for the company for the next seven operational years is as follows.

period cash flows

0 ($950,000)

1 $90,000

2 $90,000

3 $90,000

4 $90,000

5 $90,000

6 $90,000

7 $90,000

Capital budgeting techniques are what will help the CFO to make determination on whether it is prudent to buy the new apple presser. The company objective is to enrich its profits that is after buying the new apple presser. If the new apple presser will not serve its purpose then it will be advisable for the management not to invest in the new venture (Kimms, 2001). The criteria that will help us in determining if it is worth investing in cash flows is first to convert the cash inflows during the expected useful years of the new presser into its present values. The present values will be equivalent to the time of acquisition. Determination of cash flows will therefore require us to first discount each of the cash flows that has a 10% as its return on investments.

Time cash flows pvif 12% present values

0 -950,000 1 -950000

1 90,000 0.89286 80357.4

2 90,000 0.79719 71747.1

3 90,000 0.71178 64060.2

4 90,000 0.63552 57196.8

5 90,000 0.56743 51068.7

6 90,000 0.45235 40711.5

7 90,000 0.40388 36349.2

NPV -548,509.10

The net present values for the apple presser at the end of its useful life will be negative. The negative value of the net present values translates to negative revenue goals. The management is therefore advised not to invest in acquiring the new presser that is if they base its analysis on the net present value techniques. The rule that is associated with the net present value is that the management will only invest in a new project that has only positive net present value. In the case of the new presser for Orchard Company its net present value is negative and therefore the management is advised to not invest its resources in acquiring the new presser.

Using the net present value technique as an appraisal for new project is accompanied by assumptions. The first assumptions is that all the cash that the new presser will generate will be immediately be re-invested, the main reason for reinvesting is for the cash flows to generate a return on investment at a rate that will be equal to the discounted rate that the company use the present value analysis. The second assumption for using the net present value technique is that the inflow and the out flow of cash excluding the initial investment will only occur at the end of each period. The good thing about using the investment technique is that it makes good use of the time value of money and its assumption of reinvesting on its cash flows will still help improving the financial status of the company.

The internal rate of return.

The internal rate of return for the new presser is going to be ($ 90,000/$950,000) which is equal to 9.47%. When basing on the internal rate of return appraisal it is advisable for the company to go ahead and make acquisition on the new presser machine. The reason being that the internal rate of return is higher than the estimated cost of capital that is 8%. The net present value and the internal rate of return are conflicting and therefore it is advisable for the management to make a decision on the appraisal technique that will best to use. The best technique that the company should use is the net present value since it make use of the time value of money.

Prepared budget

prepared apple products

net revenue 8844250

less cost of goods sold 1061310

gross margin 7782940

12%

The budgeted income statement is prepared with a production estimate units sales of 16,000. It is therefore a requirement for the production department at orchards limited to make its budget on materials, labor and the overheads. The budget will be on the basis of what the company expect to sale and what is expected to be found in the inventory. The assumption that is held when making the budgeted financial statement is that its liabilities and interest expense are to remain the same. However it would be good after the estimates have been determined to make a revision on the amounts. It is expected also to have the expected amounts to also be revised. It is also prudent for the company to make sure that it has considered the effect of the external factors that are associated with acquiring the new presser. A good example of that factor is the prepaid expense. The prepared expense usually do not have any effect on the sales. The financial statement is a yearend estimate and an assumption is made that all the estimates for the coming financial years will be met (Hofmann, 2007).

The budget made that is starting on august 2012 its total sales will be estimated at $ 3624,411. The sales estimates is based on historical data that was obtained from the past financial years. The estimate of gross profit as a percentage of sales is expected to have an upward trend.

Developing a budget is best if the company at first make a forecast of what really is the driving force of its financial activities. The initial forecast is to be make sales forecast (Garrison, 2003). Then an estimate of the past sales history and determination of what is most likely to take place when the new apple presser will be bought. The percentage of sales method is used in preparation of the company budget. Orchard limited uses 12% of its revenue that is as a percentage for the gross margin. Determination of orchards expenditure will most likely depend on looking at the past changes in sales that is as a percentage of the overall revenue that is expected to be generated by the new apple presser

References

Kimms, A. (2001). Mathematical programming and financial objectives for scheduling projects. Boston: Kluwer Academic.

Budget estimates: Current practices and alternative approaches. (2005). Washington, D.C.: Congressional Budget Office.

Hofmann, K. P. (2007). Psychology of decision making in economics, business and finance. New York: Nova Science.

Garrison, R.H., Noreen, E.W. and Brewer, P.C., 2003. Managerial accounting. New York: McGraw-Hill/Irwin.

Cite this page

Orchard's New Presser Appraisal - Free Essay on Investments. (2019, Sep 03). Retrieved from https://speedypaper.net/essays/orchards-new-presser-appraisal

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay Example: Employment Relations

- Essay Example on Tourism and Climate Change

- Agriculture and Inequality - Essay Example for Everyone

- Tender Sustainability Report, Free Paper for Your Academic Needs

- Solenoid - Physics Essay Example

- Free essay on the program for gifted students in the Kingdom of Saudi Arabia

- Susan Glaspell's Trifles and Feminism. Free Essay

Popular categories