| Type of paper: | Essay |

| Categories: | Management Marketing Business |

| Pages: | 15 |

| Wordcount: | 3931 words |

2.2. Marketing Impact

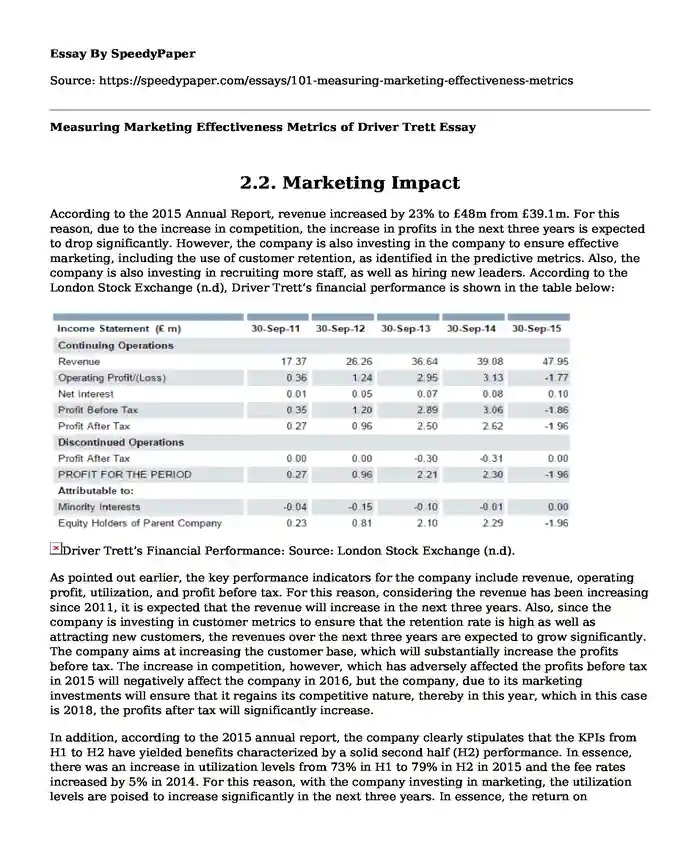

According to the 2015 Annual Report, revenue increased by 23% to £48m from £39.1m. For this reason, due to the increase in competition, the increase in profits in the next three years is expected to drop significantly. However, the company is also investing in the company to ensure effective marketing, including the use of customer retention, as identified in the predictive metrics. Also, the company is also investing in recruiting more staff, as well as hiring new leaders. According to the London Stock Exchange (n.d), Driver Trett’s financial performance is shown in the table below:

As pointed out earlier, the key performance indicators for the company include revenue, operating profit, utilization, and profit before tax. For this reason, considering the revenue has been increasing since 2011, it is expected that the revenue will increase in the next three years. Also, since the company is investing in customer metrics to ensure that the retention rate is high as well as attracting new customers, the revenues over the next three years are expected to grow significantly. The company aims at increasing the customer base, which will substantially increase the profits before tax. The increase in competition, however, which has adversely affected the profits before tax in 2015 will negatively affect the company in 2016, but the company, due to its marketing investments will ensure that it regains its competitive nature, thereby in this year, which in this case is 2018, the profits after tax will significantly increase.

In addition, according to the 2015 annual report, the company clearly stipulates that the KPIs from H1 to H2 have yielded benefits characterized by a solid second half (H2) performance. In essence, there was an increase in utilization levels from 73% in H1 to 79% in H2 in 2015 and the fee rates increased by 5% in 2014. For this reason, with the company investing in marketing, the utilization levels are poised to increase significantly in the next three years. In essence, the return on relationships (ROR), which is characterized by high customer retention rate is effective in gauging the marketing strategies for a company where a high retention rate signifies a high rate of effectiveness (Gummesson 2004). For this reason, this will significantly increase the revenues, which are expected to grow due to increase in investment level. Since competition is a major factor for determining Driver Trett’s success, which as pointed out earlier is expected to increase owing to the globalization of the competitor companies, as well as increasing their effectiveness and efficiency. The market share is also expected decrease due to the high competition. However, Driver Trett is poised to curb the competition by ensuring that it capitalizes on positive marketing strategies. For instance, the company aims at capitalizing on effective leadership as a form of marketing metric, where success in each operational country dictates success in marketing. Coupled relative customer satisfaction, commitment, relative perceived quality, the company is expected to curb competition. In light of this view, the external environment is expected to push the company for more efficiency and competitiveness, and thus, the forecasted key performance indicators, as shown below, will be positively affected by September 30, 2018.

Revenue for Driver Trett

Operating Profit/Loss of Driver Trett

Profit Before Tax of Driver Trett

About the test and learn environment, the company can include monthly information instead of yearly information so that it can be able to track the data and information sources, which include the monthly record of financials, such as balance sheet and income statements. In this case, the company will be able to track the effectiveness of the marketing metrics used, particularly on the financial metrics. In addition, other methodologies that the company can use include using a number of clients served on a monthly basis. The company can also use a number of new clients on a monthly basis, which can subsequently use to test and learn on how the level of external competition will shape the company. In case that the revenues or profits show that the company is making losses, it can adjust the marketing metrics in a way that will significantly increase the number of clients to increase the profitability to allowable limits. Besides, the company can further divide the metrics to cover different regions so as to make decisions on which region or country requires what marketing strategies.

2.3. Marketing Dashboard

| Marketing Metric | Trigger Levels |

| Oil Prices | Oil price drop, which leads to increase in construction. |

| Customer loyalty. | Number of clients drop, retention drops. It signifies the need to change the marketing strategy. |

| Profits (ROI, ROA, EVA) | Drop in profits dictates a change in strategy. |

| Market share | Drop in market share advocates for increase in marketing strategies. |

| Customer Preference | Drip in brand awareness and attractiveness indicates the need for changing the marketing strategy. |

There are various marketing strategies that Driver Trett can use to positively influence the external environment. These are shown in yellow, and are pricing advertising, merchandise allowances, consumer promotions, cooperative advertising and hiring marketing sales force. These will subsequently lead to consumer preference, channel push consumer loyalty, and market coverage. The effectiveness of the marketing strategies will yield increased profits and market size as well as drive sales and optimize profits and revenues, but the company has to finance the marketing strategies using investment assets and marketing expenses. If the returns or profits for a particular strategy are low, a revision is required. The above trigger levels will allow the company to adopt better marketing strategies.

Company Review

Chick- fil-A is a privately-owned restaurant that has its headquarters located near Atlanta Georgia. The steady growth witnessed by this fast food restaurant since it opened its doors in 1967 has made it become the largest quick service chicken restaurant in the United States of America. With at least 1800 locations in 41 states, this organization manages to make an annual turnover of over $5 billion. Chick-fil-A has over the years managed to be relevant in the fast food industry despite being in an industry that is flooded with beef products such as hamburgers that are peoples’ most preferred food. Since its inception, this organization ensured that it secured and bought premium units in the market. Chick-fil-A also purchased several high-profile market locations to increase its reach to its customers. As a result of its great marketing strategy, Chick-ail-A has witnessed significant lifts in both brand affiliation and brand awareness within the American market. According to an annual study done by the restaurant, Atlanta saw a 60% increase in people who recognize it as the best fast food restaurant (Sang-Shik Lee 2011).

Chick-fil-A is an outstanding concept that in just a few years it grabbed the title of Americas Largest Chicken Chain Restaurant away from KFC. Its efforts to open new branches all over the nation explain how it has been able to accomplish that. This fast food chain does a lot of work in attracting and retaining its customers. It goes to the extent of holding celebrations for newly opened stores where the customers get to compete for prizes such as free sandwiches, chicken, sodas, and balloon rides. Such events play a great role in attracting customers to these restaurants. Chick-fil-A is a contrast to the conventional QSR that involves operations that are more complex and have broader menus. This organization's unit volume is more than $3million, which is the highest average of any limited service chain in existence. Considering Chick-fil-A’s unit volumes, it outdoes its main competitors who include Panera Bread, Chipotle, and McDonald’s. Much success of this organization traces to its ownership model. To open a Chick-fil-A franchise, one only needs $5,000. Because of this, the restaurant receives approximately 20,000 franchise inquiries annually. To make sure that their customers come back and that they increase their chances of success, Chick-fil-A has a limited menu that is available all day long and thus relatively easy to operate (Sang-Shik Lee, 2011).

Introduction of PESTEL Analysis

Most businesses have the urge of going international so that they can become more lucrative and at the same time display their products and services to the international market. Going international is however not an easy process since there are many factors that need to be considered. The political economic, social, technological, environmental, and legal issues surrounding the preferred new area of operation should be taken seriously. Different states have different laws and regulations that affect their business environment. Chick-fil-A one of Americas best fast food restaurant should also consider the different factors before it decides to open operations in a different country or region. This paper will discuss the political, social, and economic aspects in the United Kingdom that this organization should take note of before moving its operations to that region.

Literature Review

A PESTEL analysis is a framework or tool used by marketers when analyzing and screening the external market environments affecting their organizations. This strategic marketing tool gauges and evaluates the macro environmental factors that may affect the performance of a company. Results obtained from this analysis make decision making and taking much easier. The varying macro-environmental factors are bound to affect business strategies. Therefore, it is prudent for an organization to adhere to the PESTEL framework. The main aim being assessing how exactly the external factors influence the performance of the business.

There are six different types of environmental factors in the PESTEL framework, which are, political, economic, social, technological, environments, and legal (Yuksel 2012). It is important to note that these factors should not be perceived as independent as they are interdependent. For instance, advances in technology can influence the economy of different markets. Therefore, whether an organization is planning to launch a new product or to enter a foreign market, the management should consider all these six factors and comprehend the largest forces that shape their choices (Lertsakthanakun, Thawesaengskulthai, Pongpanich 2012). For a business to be successful, its leadership should understand that political, economic, social, technological, legal and environmental issues vary from nation to nation (Mackos 2015). This means that they ought to have a comprehensive understanding of the market they are about to deal with. At the same time, PESTEL analysis assists the management in knowing how the dynamics of one market may influence the dynamics of another (Brealey 2012).

Berk (2007) suggests that politics plays a crucial role in business since there must be a balance between free markets and systems control. As world economies outdo domestic economics, organizations should consider numerous threats and opportunities before opting to expand into new regions. This also applies to organizations identifying optimal areas for sales or production. Political factors that companies should keenly watch include tax policies, government stability, entry mode regulations, social policies, and trade regulations. In the business world, a nation’s political environment is the least predictable element. Note that political instability may hinder business operations.

Economic factors are the metrics that evaluate the economic health of any nation. The economic state of a state or a region is poised to alter a lot during the organization’s life span. Before a company commits its resources to a country or economic region, it should gauge the current levels of international trade, economic growth, unemployment, and inflation. It can carry out its strategic plan as required. Other economic factors to consider before setting shop in a new region are disposable income, interest rates, and credit accessibility.

Social Factors in Amalysis of PESTEL

In the PESTEL analysis, the social factors assess the mental state of consumers or individuals in each market (demographic factors). Social indicators such as inflation, GDP, and exchange rates are significant for management since they will assist them in knowing and deciding when to borrow. In addition, demographic factors assist organizations in finding out how an economy might react to certain dynamics. Social factors that an organization should focus on include education levels, wealth distribution, lifestyle changes and trends, and the general population demographics (Issa, Chang, and Issa 2010).

Both the governments and consumers do penalize organizations for having adverse effects on the environment. Governments impose huge fines upon organizations for polluting. However, governments also reward companies that have a positive impact on the environment. Consumers, on the other hand, are usually willing to switch their loyalty if a firm is ignoring its environmental responsibilities. Environmental factors that a company should consider when relocating to a new area or introducing new products or services are the waste disposal laws, environmental protection laws, and the energy consumption regulation (Shilei and Wong 2009).

Evaluating the technological factors entails the company recognizing the potential technological advances available. Such advancements can aid in optimizing internal efficiency and thus prevent products or services from becoming obsolete. The role played by technology in business is increasing annually. This trend is poised to continue since research and development drive innovations. Recognizing new and available technologies to maximize internal efficiency is a great asset to management. The best approach to take when planning to utilize technological factors is adapting according to the changes. The technological factors to be considered by new market entrants are innovations and discoveries, the rate of technological innovations and advances, the rate of technological obsolesce, and new technological platforms (Issa, Chang and Issa 2010).

Sarda et al (2013) state that the legal part of the PESTEL analysis involves learning the regulations and laws that govern a region of interest. This is usually critical, as it will assist the company in avoiding unnecessary legal charges. The common legal factors that firms focus on are competitive regulations, employment regulations, product regulations, antitrust laws, and patent infringements. It is prudent for an organization to carry out a PESTEL analysis prior to deciding which region they need to introduce and market their products or services. Understanding all the discussed factors is the first step to addressing them. While carrying out the analysis, the management should also be very keen on factors that have competitive and strategic consequences.

Below is a table giving a brief SWOT analysis of Chick-Fil-A

Strengths

- Strong market share

- Reputable brand

- Strong marketing and advertising Weakness

- Limits customers by offering only chicken

Opportunities

- Penetration into international markets

- Increase variety of foods

- Offer healthier food options Threats

- Strong competition from Popeye’s and KFC

- Law suits by government agencies

- Increase in raw material prices

Looking at the SWOT analysis it is obvious that most factors being addressed are mainly within the United States. Therefore, a PESTEL analysis is prudent since it covers factors that will affect Chick-fil-A incase the company decides to move to a foreign market.

PESTEL Analysis and Recommendations

According to Atrill (2009), Pestle analysis is a common technique used for evaluating the general business environment in order to manage the future threats and opportunities from possible environmental changes by looking into the political, economic, social, technological and environmental issues. The following discussion will execute a PESTLE analysis on the fast food industry in the United Kingdom with a special focus on Chick-fil-A an American fast food restaurant that intends to establish its chain of fast food restaurant in the country. However, the discussion will only dwell in the political, social, and economic part of the analysis.

The United Kingdom is among the most attractive global locations since it has grown to be among the strongest nations. This rise in the status of the UK boosted international business in the region. Many foreign investors seek to expand their businesses in the UK mainly because of the size of the market and the region’s potential growth (BBC 2014). Over the decades, the UK has become increasingly integrated with other parts of the globe since it has opened its borders to an array of cross-border economic activities. The main challenges that Chick-fil-A is poised to face in the UK is local differentiation, the strengthening of major competencies in specific areas and business activities, and getting the right strategic objectives for the reduction of costs (Grant 2016).

Political Factors

Many political factors will affect Chick-fil-A both in the present and in the future if the company decides to open branches in the United Kingdom. One of these factors will be tax rate levied by the government. The high taxes in the region are bound to affect the operations and objectives of the company since it means that most of the customers will not have enough disposable income to spend on luxuries such as the fast foods offered by Chick-fil-A. The continuous deficit witnessed in the UK does not give a guarantee that the future of this organization will be bright. Currently, the interest rates on the UK stand at an all-time low of 0.25% (Bankofengland.co.uk, 2017). This is positive for a large organization such as Chick-fil-A since it will be in a position of securing loans for purposes of capital expansion. The borrowing of loans may take the form of both long and short-term loans from banks and other financial institutions. Alternatively, Chick-fil-A may opt to issue corporate bonds (Arnold 2008).

Generally, the UK political system based on its parliamentary democracy will provide Chick-fil-a with a low-risk political environment to operate in (Anon 2013). Therefore, this makes the United Kingdom a relatively safe and secure market for Chick-fil-A to make long-term capital investments in which the organization might think twice in case of volatile economic environments.

Economic Factors

The current state of the economy in the United Kingdom is poised to have a major impact on Chick-fil-A. Since 2007, the region has been unstable economically. After the onset of the global financial crisis in 2008, the subsequent year saw the GDP growth of the region revert to negative figures with -1 % reduction in the economy. This was later followed by even worse economic outcomes in 2009 with a contraction of -4%. Low levels of growth were later witnessed in 2010 and 2011 that saw a growth in GDP of 1.8% and 0.8% respectively (World Bank 2017). The recent withdrawal of Britain from the European Union has also had a negative impact in the United Kingdom. High rates of unemployment and less household disposable income will also work against the success of Chick-fil-A.

Cultural and Social Changes

There are many cultural and social changes happening in the UK presently that may have a significant impact on the performance of a fast food restaurant such as Chick-fil-A. Recently, many people are striving at living healthy by consuming whole foods as compared to fast foods. This trend has also developed in the UK. However, this may not necessarily act to the disadvantage of Chick-fil-A since there are still some potential fast food customers and the organization has a chance of introducing whole meals in their menu to fit the demand of its customers. The United Kingdom being a culturally diverse region also gives this organization a chance of venturing into the preparation of other types of foods that can be appealing to different people. In addition, Chick-fil-A has the opportunity of introducing customers to its delicacies.

Placing Recommendations

The UK is a very favorable place for Chick-fil-A to start running its operations. The calm political environment provided in such a region is what an organization will look for to create a successful business. The low-interest rate in the region gives the company a good opportunity to develop its franchise. Franchising would be the best approach since loans are available and different people and companies can secure them and start their own businesses. Having a joint venture with other restaurants in the region is also ma viable option since it will expose Chick-fil-A and its fast food products to the UK market. However, the unstable economic conditions are the main factors that Chick-fil-A should refrain from doing business in the UK. These unstable conditions are not good for business models such as that of Chick-fil-A since most people consider fast food as a luxury that can be done away with especially if there is no disposable income.

Chick-fil-A Company Conclusion

PESTEL Analysis in this case is a very strong marketing tool that Chick-fil-A can use to gauge whether it can enter a market. In this study, the UK is a good market place for the organization to set shop bust some economic factors makes the region not favorable. However, with the right approach, Chick-fil-A can be able to survive the unpredictable economic situations in the UK since it is a strong economic region.

The study mainly concentrated on the political social and economic aspects of the United Kingdom since these three are poised to have a direct impact on Chick-fil-A performance. The company already has the needed technology to run its operations and UK being advanced in terms of technology, Chick-fil-A is guaranteed to get the required tools and equipment in this region. In addition, this restaurant is not going to have any direct impact in the UK’s environment. Lastly, Chick-fil-A has constantly provided its US clients with quality and therefore, the restaurant expects to replicate the same in the UK thus the analysis did not have to dwell much on the legal issues. Generally, the technical, environmental and legal issues that can affect Chick-fil-A in the UK are similar to those that already affect the company in the US.

References

Anon., 2013. The world fact-book. [online] Available at: https://www.cia.gov/library/publications/the-world-factbook/geos/uk.html [Accessed on 18/01/13]. [Accessed 22 Mar. 2017].

Arnold, G., 2008. Corporate financial management. London: Pearson Education.

Atrill, P., 2005. Financial management for decision makers. London: Pearson Education.

British Broadcasting Channel (BBC)., 2014. UK economy grew 0.9% in second quarter, says ONS - BBC News. [online] Available at: http://www.bbc.com/news/business-29422267 [Accessed 22 Mar. 2017].

Berk, J.B. and DeMarzo, P.M., 2007. Corporate finance. London: Pearson Education.

BoE 2017., Monetary Policy Committee announcement dates for 2017 and 2018 | Bank of England. [online] Available at: http://www.bankofengland.co.uk/publications/Pages/news/2016/070.aspx [Accessed 22 Mar. 2017].

Brealey, R.A., Myers, S.C., Allen, F. and Mohanty, P., 2012. Principles of corporate finance. New York: McGraw-Hill Education.

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. New Jersey: John Wiley & Sons.

Issa, T., Chang, V. and Issa, T., 2010. Sustainable business strategies and PESTEL framework.

Lertsakthanakun, J., Thawesaengskulthai, N. and Pongpanich, C., 2012. Servitization decision-making framework for Thai manufacturing companies. International Journal of Business and Management, 7(12), p.147.

Makos, J., 2015. An Overview of the PESTEL Framework. PESTLE Analysis, 18.

World Bank 2017., Data.worldbank.org. Retrieved 22 March 2017, from http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG

Sang-Shik Lee, (2011). A Case Study of Chick-fil-A (Fastfood Restaurant in U.S.) Based on Service Profit Chain Concept. Jounal of Korea Service Management Society, 12(4), pp.1-18.

Sarda, A., Kumar, V.A., Chetia, B., Gangapuram, R., Taneja, S. and Jayaraman, R., 2013. Strategic Priorities for the Indian Telecom Industry in the Next Decade. Prabandhan: Indian Journal of Management, 6(4), pp.5-18.

Shilei, L. and Yong, W., 2009. Target-oriented obstacle analysis by PESTEL modeling of energy efficiency retrofit for existing residential buildings in China's northern heating region. Energy Policy, 37(6), pp.2098-2101.

Singh, A.K., 2016. Selecting Regional Postponement Centre Using PESTLE–AHP–TOPSIS Methodology: A Case Study in a Pharmaceutical Company. Global Business Review, 17(5), pp.1266-1268.

Yüksel, I., 2012. Developing a multi-criteria decision making model for PESTEL analysis. International Journal of Business and Management, 7(24), pp.52-66.

Cite this page

Measuring Marketing Effectiveness Metrics of Driver Trett. (2018, Mar 14). Retrieved from https://speedypaper.net/essays/101-measuring-marketing-effectiveness-metrics

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay about the Effects of Domestic Violence on Nurses

- Justification Letter for Purchase of Equipment. Essay Sample.

- Comparison Essay Sample on the Capital Structures of Coca-Cola Company and Nike

- Nursing Essay Example: Anxiety and Medication Errors

- Research Paper on Preventing Diabetes Among Elementary Students

- Essay Sample with Plot Analysis - A Rose for Emily by William Faulkner

- Free Essay Example - Human Experience of Illness

Popular categories