| Type of paper: | Essay |

| Categories: | Finance Ethics |

| Pages: | 6 |

| Wordcount: | 1478 words |

Financial Ratios

Financial ratios are the outcome numerically gained through the division of certain financial data with others, and they are employed in expressing the relationship of various financial variables. The balance sheets coupled with the financial statement are two very critical and mostly employed financial information sources in the calculation of ratios (Bob Evans Farms Inc., 2017).

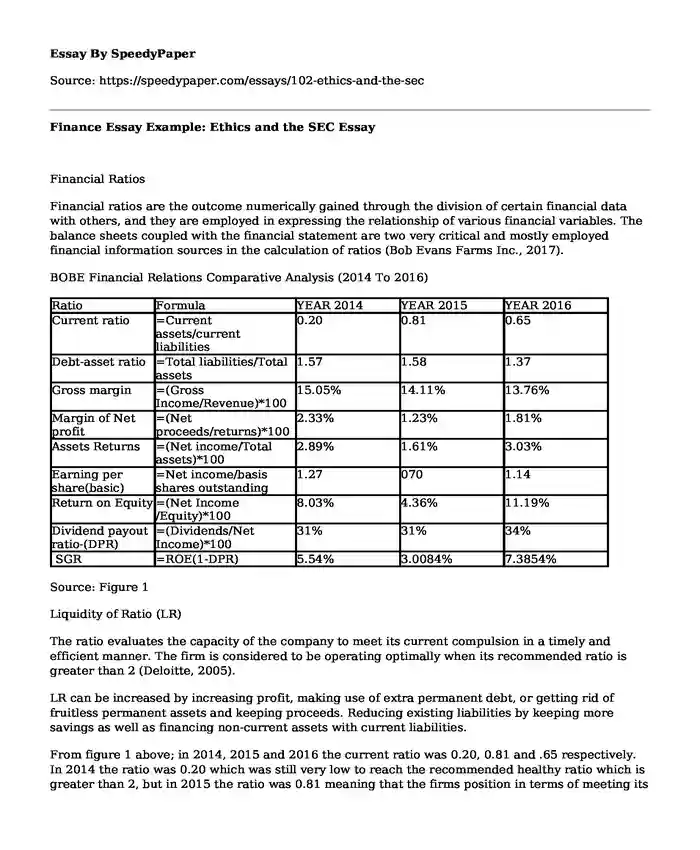

BOBE Financial Relations Comparative Analysis (2014 To 2016)

| Ratio | Formula | YEAR 2014 | YEAR 2015 | YEAR 2016 |

| Current ratio | =Current assets/current liabilities | 0.20 | 0.81 | 0.65 |

| Debt-asset ratio | =Total liabilities/Total assets | 1.57 | 1.58 | 1.37 |

| Gross margin | =(Gross Income/Revenue)*100 | 15.05% | 14.11% | 13.76% |

| Margin of Net profit | =(Net proceeds/returns)*100 | 2.33% | 1.23% | 1.81% |

| Assets Returns | =(Net income/Total assets)*100 | 2.89% | 1.61% | 3.03% |

| Earning per share(basic) | =Net income/basis shares outstanding | 1.27 | 070 | 1.14 |

| Return on Equity | =(Net Income /Equity)*100 | 8.03% | 4.36% | 11.19% |

| Dividend payout ratio-(DPR) | =(Dividends/Net Income)*100 | 31% | 31% | 34% |

| SGR | =ROE(1-DPR) | 5.54% | 3.0084% | 7.3854% |

Source: Figure 1

Liquidity of Ratio (LR)

The ratio evaluates the capacity of the company to meet its current compulsion in a timely and efficient manner. The firm is considered to be operating optimally when its recommended ratio is greater than 2 (Deloitte, 2005).

LR can be increased by increasing profit, making use of extra permanent debt, or getting rid of fruitless permanent assets and keeping proceeds. Reducing existing liabilities by keeping more savings as well as financing non-current assets with current liabilities.

From figure 1 above; in 2014, 2015 and 2016 the current ratio was 0.20, 0.81 and .65 respectively. In 2014 the ratio was 0.20 which was still very low to reach the recommended healthy ratio which is greater than 2, but in 2015 the ratio was 0.81 meaning that the firms position in terms of meeting its current obligations worsened, however in 2016 it showed some marginal improvement .although a marginal improvement was registered it’s not good enough since the safe ratio threshold has not been reached. Technically the trend is positive but very marginal (Fuller, 1981).

Total Debt to Assets

This ratio measures the virtual responsibilities of a firm; Debt/ Total Assets of more than 0.6 shows that the equity positions of the owner are below 50%

This ratio can be enhanced by reducing a firm`s debt capacity as well as the strengthening of controls over purchases (Mayo, 2008).

From Figure 1 above, 1.57%, 1.58% and 1.37% in 2014, 2015, and 2016 respectively as being Total Debt to assets. In 2014 the ratio was 1.57% however it increased marginally to 1.58% in the subsequent year (2015).but in 2016 the rate gradually decreased to 1.37% indicating a positive trend to investors of BOBE.This trend means that the organization is reducing its debt percentage but effectively and efficiently controlling its purchases.

Profitability Ratios

The capacity of a company to produce income in the admission of expenses can be observed via profitability ratios.

Return on equity (ROE)

This is the total net income brought back as a proportion of equity to shareholders. ROE is well-liked with financiers since it relates the statement of income (net profit/loss) to that of the balance sheet (equity of shareholders) (Monteiro, 2006).

From figure 1 above ROE for Company in the year 2014, 2015, and 2016 are 8.03%, 4.36%, and 11.19% respectively. In the year 2016 the organization returned 11.19% total revenue as a proportion of equity to shareholders which is a much improvement compared to that which it achieved the previous year 2014. But in the year 2014 Firms ROE was at a rate of 8.03% which saw a company in the year 2015 registering a drop in the ROE by 3.67%. An increase from 4.36% in 2015 to 11.19% in 2016 is positive for the company since the organization is returning 11.19% total revenue as a proportion of shareholders equity.

Sales Profit Margin

Offers content on a company’s capacity to produce finances internally. Poor margins are a critical cause for a company to be distressed regarding finances and in the end to become bankrupt. Improved margins signify a likely decrease in production cost factors as well as costs of inventory and an increase in the company’s prices of products. As much as it is critical to have sales high-profit margin returns that are earned by stockholders tend to be impacted by stock prices. Higher margins of profits may not realize an increase in investors’ returns if the stocks are sold at a price that is greater than the pre-share sales (Mayo, 2008).

As per our figure 1 above, the Profit margin on sales has been decreasing steadily from 15.05%, 14.11% and 13.76% in 2014, 2015 and 2016 respectively. This is a negative trend which clearly indicates that the firm needs to reverse this negative trend; it has to device ways to reduce the cost of goods sold or increase margins on its products or services. It is worth noting that a firm should neither have a high ratio nor a low ratio.

The net profit margin

This ratio shows what a company makes with respect on total sales. The higher rate is an indication that the company is more efficient in turning its sales into actual profit. In figure 1above, net profit margin 2.33%, 1.23% and 1.81% for 2014, 2015 and 2016 respectively. In the year 2014 the net profit margin was 2.33% which declined drastically with more than 1% point in the following year to 1.23%, but from 2015 to 2016 the ratio increased to 1.81%. This indicates the fluctuations in net profit margin; this in itself is negative since the firm cannot predict its net profit with precision as it keeps fluctuating.BOBE needs to come up with measures that will steadily stimulate sales, for examples increasing sales advertisements.

Payout ratio of Dividends (DPR)

The DPR is the dividends amount paid to shareholders about the accrued company net income. The funds that are not paid out in the form of dividends to shareholders are retained by the firm for development. The funds that are retained by the firm are referred to as retained earnings (Rappaport, 1986).

From figure 1 above, we realize that DPR was constants in the year 2014 and 2015 that is the rate was 31% however in the year 2016 the DPR was 34%.This is an increasing trend, however, if the organization can effectively consistently thrive to improve on its currents assets position and equally reduce its current liabilities then this very fact may help in improving its current ratio.

The current trend is positive to shareholders who consider if they should put their investment in a company that is profitable and pays dividends or deal with a profitable company whose potential for growth is very high. In a nutshell, this arrangement accounts for the stable income against reinvesting for likely future revenues, presuming a firm has some net income

Earning per share (EPS)

EPS serves as an indicator of Firms profitability; it is a portion of a firm’s profit that is dispersed to every exceptional share of ordinary stock. It is one of the vital determinant variables in determining a stock’s value (Drake, 2005).

From figure 1 above, the EPS in 2014 which was 1.27 decreased to 0.70 in the following year 2015 however in the year 2016 EPS increased to 1.14.this was positive. This could be attributed to steady decline the basic shares outstanding as well as increase in Net income.

Sustainable Growth Rate - SGR

Sustainable growth is the growth rate that is the most practical approximation of the increase in a firm’s revenues, presuming that the firm does not change its structure of capital.

As at Figure 1, Bob Evans Farms Inc. SGRs between 2014 and 2016 are 5.5408%, 3.0087, and 7.3856% respectively. This means that in 2016 there was increased SGR as compared previous to 2015 whose SGR was the lowest of the three years in comparison.

According to Drake (2005), the maintained growth could act as a pointer of challenges awaiting the company. For instance, if real growth is more than maintained growth for some time it could be a fact that the higher growth may not sustain the company resulting in a considerable reduction in development given that the company could be reducing its finances. Equally, if the firm’s maintained rate of growth is greater than its real rate of growth, this could mean that the firm has maximized on shareholders wealth.

Conclusion

From the comparative analysis for the firm over the three-year period, BOBE is a company that has a brighter future. For example ROA was at 2.89% in 2014 to 3.03%% in 2016,Current assets increased from 0.2 in 2014 to 0.65 in 2016,SGR increased from 5.5% in 2014 to 7.4% in 2016.The SGR is the most realistic estimate of growth, and this is evidenced by the previous year`s growth rate.

References

Bob Evans Farms Inc., (2017), Marketwatch.com. Retrieved 31 January 2017, from http://www.marketwatch.com/investing/stock/bobe/financials/income-statement/

Deloitte, (2005), “Sustainable Growth: Is There Room to Grow?” A Deloitte Research Viewpoint,

Fuller, R. J., & Perry, G. H. (1981), Inflation, return on equity, and stock prices. The Journal of Portfolio Management, 7, 19-25.

Mayo, H. (2008). Investments: an Introduction. Ohio: Thomson/South-Western.

Monteiro, A. (2006). A quick guide to financial ratios: The Citizen: Money web Business Insert, Page 3.

Rappaport, A. (1986), Creating shareholder value. New York: The Free Press.

Drake, P. (2005).Sustainable growth Notes on the concept and estimation of sustainable growth rates

Cite this page

Finance Essay Example: Ethics and the SEC. (2018, Feb 26). Retrieved from https://speedypaper.net/essays/102-ethics-and-the-sec

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Education Essay Sample: How to Become an Outstanding Student

- Effects of Participation Trophies - Research Summary Essay Example

- Free Essay on Physical, Psychosocial and Cognitive Development

- Definition Essay Example: The Term Global Citizenship

- Free Essay about Unethical Research

- Free Essay Example: Supreme Court Side With Baker

- Free Essay. Culture, Compensation, and Leadership Contribution to the Ethics Problems at Putnam

Popular categories