| Type of paper: | Essay |

| Categories: | Economics Finance Macroeconomics Budgeting |

| Pages: | 4 |

| Wordcount: | 945 words |

Capital budgeting process

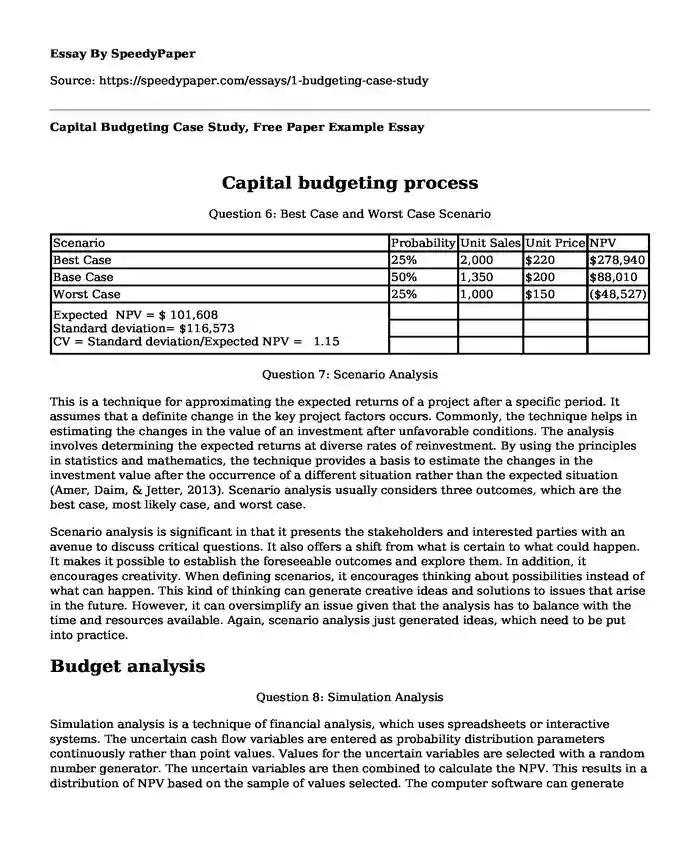

Question 6: Best Case and Worst Case Scenario

| Scenario | Probability | Unit Sales | Unit Price | NPV |

| Best Case | 25% | 2,000 | $220 | $278,940 |

| Base Case | 50% | 1,350 | $200 | $88,010 |

| Worst Case | 25% | 1,000 | $150 | ($48,527) |

| Expected NPV = $ 101,608 Standard deviation= $116,573 CV = Standard deviation/Expected NPV = 1.15 | ||||

Question 7: Scenario Analysis

This is a technique for approximating the expected returns of a project after a specific period. It assumes that a definite change in the key project factors occurs. Commonly, the technique helps in estimating the changes in the value of an investment after unfavorable conditions. The analysis involves determining the expected returns at diverse rates of reinvestment. By using the principles in statistics and mathematics, the technique provides a basis to estimate the changes in the investment value after the occurrence of a different situation rather than the expected situation (Amer, Daim, & Jetter, 2013). Scenario analysis usually considers three outcomes, which are the best case, most likely case, and worst case.

Scenario analysis is significant in that it presents the stakeholders and interested parties with an avenue to discuss critical questions. It also offers a shift from what is certain to what could happen. It makes it possible to establish the foreseeable outcomes and explore them. In addition, it encourages creativity. When defining scenarios, it encourages thinking about possibilities instead of what can happen. This kind of thinking can generate creative ideas and solutions to issues that arise in the future. However, it can oversimplify an issue given that the analysis has to balance with the time and resources available. Again, scenario analysis just generated ideas, which need to be put into practice.

Budget analysis

Question 8: Simulation Analysis

Simulation analysis is a technique of financial analysis, which uses spreadsheets or interactive systems. The uncertain cash flow variables are entered as probability distribution parameters continuously rather than point values. Values for the uncertain variables are selected with a random number generator. The uncertain variables are then combined to calculate the NPV. This results in a distribution of NPV based on the sample of values selected. The computer software can generate graphs and other statistics, which the decision makers can use to make decisions (Lee et al., 2009). Simulation analysis allows investors to convert an investment chance to a choice. Its major advantage is that it can factor in different values for various inputs. In addition, it is also very refined on that computer a computer software cam does not make mistakes. However, its use has a limit by the fact that managers are unable to specify the variables resulting in variables limited values (Zio, 2013). Another disadvantage is that simulation tends to assume the probability of extreme events such as a financial crisis.

Question 9

This project has a coefficient of variation of 1.15, which is above the average variation range of 0.2-0.4. This places the project in the high-risk category since it has a higher coefficient of variation than the common project. The coefficient of variation measures the stand-alone risk. The stand-alone risks assume that a company’s project is pursuing a single asset separate from other assets. Therefore, it is measured by the variability of the single project. It is a measure of the variability of the expected returns.

Question 10

The project has a risk above average. The adjusted cost of capital, in this case, would be 17%. At this rate, the NPV is $89,421 which, is still acceptable. Therefore, the risk-adjusted cost of capital yields an acceptable NPV. Thus, the new line is acceptable. However, considering there are other risk factors to be considered, the decision is not necessarily dependent on NPV.

Capital budgeting techniques

Question11: Other Subjective Risk Factors

The numerical analysis to determine the risk involved cannot cover all the risk factors involved in a project. The subjective risk factors are not integrated in the numerical analysis of risk. One of the subjective risk factors is expensive lawsuits. An expensive lawsuit will decrease the cash flow in that money is spent in the lawsuit. In addition, the name of the company is tarnished which will consequently reduce sales. Reduced sales translate to less cash flow leading to a lower net present value from the initial numerical analysis. Other decision-making elements such as payback period and IRR will also change meaning the initial decision about the viability of the project are compromised.

Another subjective risk factor is deployment of assets. The risk analysis initially done incorporates all the assets available. In the course of business, it is possible for the company to deploy some of the assets to other projects thus affecting the project. If the company for example deploys the machinery, production will be interrupted which can result to low supply than demand. Integrating the idea of competition into this scenario, the company will make a loss. Deployment of assets can affect other activities rather than production. There are those assets that aid the production process and their interruption translates to an interruption in the production process. Thus, in addition to the calculated project risk, there are those other hidden risks, which can make a project have a high risk than that found through analysis.

References

Amer, M., Daim, T. U., & Jetter, A. (2013). A review of scenario planning. Futures, 46, 23-40.

Baker, H. K., & English, P. (2011). Capital budgeting valuation: Financial analysis for today's investment projects. Hoboken, NJ: Wiley.

Lee, A. C., Lee, J. C., & Lee, C. F. (2009). Financial analysis, planning & forecasting: Theory and application. Singapore: World Scientific.

Rüschendorf, L. (2013). Mathematical risk analysis. Springer Ser. Oper. Res. Financ. Eng. Springer, Heidelberg.

Zio, E. (2013). The Monte Carlo simulation method for system reliability and risk analysis (p. 198p). London: Springer.

Cite this page

Capital Budgeting Case Study, Free Paper Example. (2017, Nov 09). Retrieved from https://speedypaper.net/essays/1-budgeting-case-study

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Media and Pop Culture - Free Essay for Everyone

- Free Essay about the "Fire in the Hole" Documentary

- Essay Example Describing the Forms of Bad Statistics

- Paper Example on Methods for Processing Ceramics and Glass

- Free Essay - Funding Types and Option

- Creating an Ideal State. Essay Example

- Essay Sample on Music Importance on the Film 'Iron Man 1'

Popular categories