| Type of paper: | Essay |

| Categories: | Finance Analysis |

| Pages: | 6 |

| Wordcount: | 1583 words |

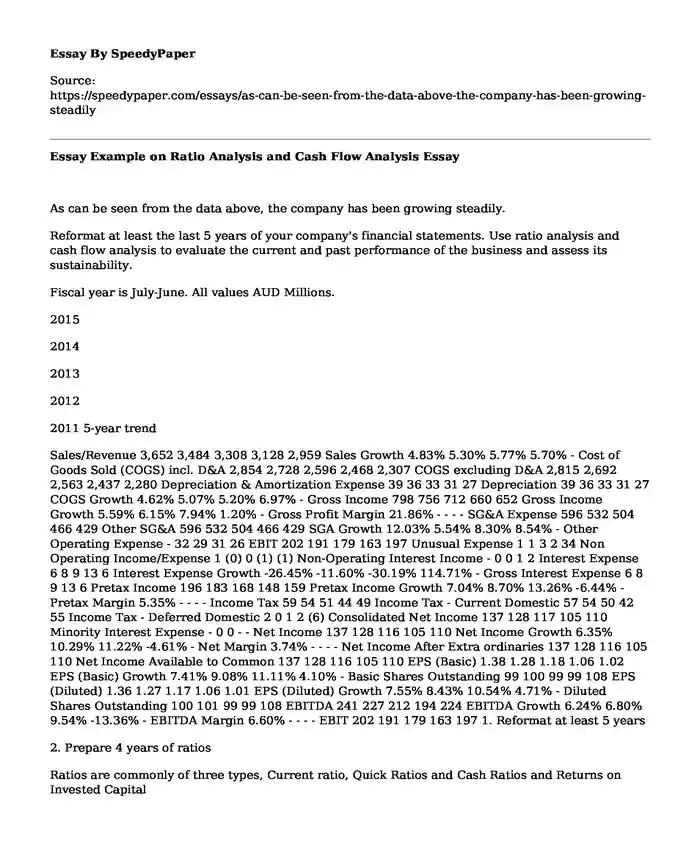

As can be seen from the data above, the company has been growing steadily.

Reformat at least the last 5 years of your company's financial statements. Use ratio analysis and cash flow analysis to evaluate the current and past performance of the business and assess its sustainability.

Fiscal year is July-June. All values AUD Millions.

2015

2014

2013

2012

2011 5-year trend

Sales/Revenue 3,652 3,484 3,308 3,128 2,959 Sales Growth 4.83% 5.30% 5.77% 5.70% - Cost of Goods Sold (COGS) incl. D&A 2,854 2,728 2,596 2,468 2,307 COGS excluding D&A 2,815 2,692 2,563 2,437 2,280 Depreciation & Amortization Expense 39 36 33 31 27 Depreciation 39 36 33 31 27 COGS Growth 4.62% 5.07% 5.20% 6.97% - Gross Income 798 756 712 660 652 Gross Income Growth 5.59% 6.15% 7.94% 1.20% - Gross Profit Margin 21.86% - - - - SG&A Expense 596 532 504 466 429 Other SG&A 596 532 504 466 429 SGA Growth 12.03% 5.54% 8.30% 8.54% - Other Operating Expense - 32 29 31 26 EBIT 202 191 179 163 197 Unusual Expense 1 1 3 2 34 Non Operating Income/Expense 1 (0) 0 (1) (1) Non-Operating Interest Income - 0 0 1 2 Interest Expense 6 8 9 13 6 Interest Expense Growth -26.45% -11.60% -30.19% 114.71% - Gross Interest Expense 6 8 9 13 6 Pretax Income 196 183 168 148 159 Pretax Income Growth 7.04% 8.70% 13.26% -6.44% - Pretax Margin 5.35% - - - - Income Tax 59 54 51 44 49 Income Tax - Current Domestic 57 54 50 42 55 Income Tax - Deferred Domestic 2 0 1 2 (6) Consolidated Net Income 137 128 117 105 110 Minority Interest Expense - 0 0 - - Net Income 137 128 116 105 110 Net Income Growth 6.35% 10.29% 11.22% -4.61% - Net Margin 3.74% - - - - Net Income After Extra ordinaries 137 128 116 105 110 Net Income Available to Common 137 128 116 105 110 EPS (Basic) 1.38 1.28 1.18 1.06 1.02 EPS (Basic) Growth 7.41% 9.08% 11.11% 4.10% - Basic Shares Outstanding 99 100 99 99 108 EPS (Diluted) 1.36 1.27 1.17 1.06 1.01 EPS (Diluted) Growth 7.55% 8.43% 10.54% 4.71% - Diluted Shares Outstanding 100 101 99 99 108 EBITDA 241 227 212 194 224 EBITDA Growth 6.24% 6.80% 9.54% -13.36% - EBITDA Margin 6.60% - - - - EBIT 202 191 179 163 197 1. Reformat at least 5 years

2. Prepare 4 years of ratios

Ratios are commonly of three types, Current ratio, Quick Ratios and Cash Ratios and Returns on Invested Capital

LIQUIDITY Current Ratio 1.62

Quick Ratio 0.36

Cash Ratio 0.13

Profitability Gross Margin +21.86

Net Margin +3.74

Return on Assets 15.39

Return on Equity 42.79

Return on Total Capital 28.52

Return on Invested Capital 28.52

3. Prepare risk ratios for cash flow analysis

Risk Ratios 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Current Ratio 1.42 1.35 1.38 1.32 1.25 1.45 1.22 1.27 1.64 1.62

Quick Ratio 0.25 0.33 0.22 0.30 0.32 0.25 0.22 0.30 0.32 0.34

Financial Leverage 4.14 4.01 3.27 2.89 2.24 5.04 4.40 3.47 2.92 2.61

Debt Equity 1.27 1.04 0.75 0.39 0.12 1.52 0.81 0.51 0.61 0.41

4. WRITE UP what happened AND WHY the ratios/ cash flow changed

Current ratios- these are generally used to measure how able a company is when it comes to paying its short term and long-term loans. When the current assets increase and the current liabilities decrease, the current ratio value increases.

Liquidity Ratios- These are the current, quick and operating cash flow ratios. The company had more liquid assets and was therefore able to cover its short-term debts.

Evaluation and profitability comparison

How is the company able to effectively and efficiently convert revenue to profit? Profitability ratios examine how successful a company is. They are also used to identify weak areas and sectors of a company and thus improve on them. Net Profit Margin, Return on Assets, Return on Equity are some of the popular ratios used.

Net Profit Margin

Indicates the quantity and value of sales after expenses have been deducted and you are left with the net profit.

JB Hi-Fi net profit margin has been growing steadily with time. In the past five years, it has been able to achieve strong results despite many economic downfalls, however there has been challenges experienced and this need to be dealt with as soon as possible.

In 2012, the company net profit margin was 3.34% whereas the average net profit margin for the overall retail industry was 2.45%..

Return on Assets

This indicates the profitability of the companys assets in generating revenue. The company has been very successful in ensuring that its assets generate a lot of revenue. Most of the resources are being used effectively, efficiently and to their full potential and this is highly encouraging. This is attracting shareholders and other investors who see the company as a good investment ground.

The companys ROA has always been higher compared to the industry average but in its own standards it has been declining and this has to be addressed at once.

Quick Ratio

This indicates how effective a company is in using its most liquid assets in paying out all its current liabilities as fast as possible. JB Hi-Fi quick ratios are alarming as they are below the industry average. Its figures have been dropping. Whereas the industrys average is about 1.92, the companys quick ratio is about 0.25-0.30.2. Prospective Analysis (15 marks)

Forecast future financial performance. Use the four valuation models outlined in class to produce an estimate of firm value, and compare to stock price. Perform sensitivity analysis and discuss the results.

Forecasting is composed of four main valuation models and these are

Industry analysis

Strategy analysis

Accounting analysis

Ratio analysis

Forecasting components include the following: Sales, ATO, PM, Dividend payout ratio and net after tax cost of debt

1.Prepare your forecasts and write up the reasons for your forecast assumptions

The basis of the forecasts is that there is a relationship between all external factors, some of which include, Industry factors, Competition factors and how the market is expanding (the rate of its growth)

My forecast is that the sales are going to increase steadily despite the tough economic situations.

Forecasts assumptions here also assume ceteris paribus in relation to the internal factors. These assumptions use databases of the competitors to forecast any changes that might take place in competitive sectors that will have an impact on the company.

Marking forecasts on the other hand include marketing, competitive and all forecast analysis.

2. Prepare your valuations and write up just the answers to your 4 models, as well as include share price on the date of your valuation (the date of your last set of reformatted financial statements (table 1)

The valuations in the forecast components are;

The actual results (either monthly, annually)

The assumption, and it should be the best assumption.

All the risks that stand in the way of the forecast have to be noted down.

The procedures that have been put in place to minimize all the risks an at the same time maximize all the available opportunities.

The fall back plans if the forecast is not realized.

What can be done to overcome all the obstacles standing in the way of achieving the targets.

3. For all of your forecasting and cost of capital assumptions1, write up your reasons for your optimistic and pessimistic outcomes (best and worst they ever did in last 5 years perhaps?) and calculate your sensitivity analysis. Only use the AOI model and Table 2 reports your sensitivity results. Again compare to share price and discuss your results

Share price forecast.

From the above, it can be noted that an increase of 7.62% is expected.

Earnings per share have also been increasing as shown below.

Earnings per share

2011 1.0

2012 1.1

2013 1.2

2014 1.3

2015 1.4

The company has been on an upward trend and we expect that to continue.

1 Sales growth, PM, ATO, cost of debt, dividend yield and cost of capital (firm)

3. Application (15 marks)

Using your sensitivity analysis, and as a potential management consultant to your chosen firm, provide a discussion as to the possible opportunities for improvement, and potential challenges for your firm. Provide remedies for these concerns. You should be quite specific in any recommendations you make.

1. Your sensitivity testing will show you that your firm will be more sensitive to one of:

a. Sales growth/cost of capital

b. PM

c. ATO

Sales growth refers to the increase in a companys average sales volume of its products or goods and this is usually calculated annually. The strategies that the company would do to be more successful and increase its sales include;

Employing very qualified sales leaders who incessantly challenge the status quo and are excellent, efficient and effective in performance management; ensuring that customers are the first priority and listening to their suggestions and needs; ensuring there is optimization of operations of sales and technology as well; be first in breaking new ground before your competitors do that and leading in sales growth.

2. Depending on which of the three above is most important to your firm, come up with some ideas for specific things that your firm can do. For example, if sales growth matters dont just say increase sales. You need to come up with creative ideas for your firm to increase sales. You never know, yours may be the next assignment sent on to your firm!

Opening of new stores in areas where the company has not yet established itself fully. It is paramount to take advantage of the big and popular name of the company and thus diversify the range of its products, especially laying more emphasis and focus on small appliances. The market for consumer electronics is yet to be tapped fully and the firm needs to capitalize on that. A strong investment program needs to be established, current stores need to be upgraded and others new ones should be established while small appliances should be highly considered as well.

References

Bartholomeusz, S. 2016, Lessons From Dick Smiths Breathtaking Implosion,

Theaustralian, View At 5 May 2016, <Http://Www.Theaustralian.Com.Au/Business/Opinion/Stephen-Bartholomeusz/Lessons-From-Dick-Smiths-Breathtaking-Implosion/News-Story/B16c95af482bf32b0aee8098a86ae34e>

Biggart, T. B., Burney, L. L., Flanagan, R., & Harden, J. W. 2010, Is A Balanced Scorecard Useful In A Competitive Retail Environment? Management Accounting Quarterly, Viewed At 5 May 2016 <Https://Www.Questia.Com/Library/Journal/1G1-251377911/Is-A-Balanced-Scorecard-Useful-In-A-Competitive-Retail>

Deloitte 2003, JB HI-FI, Viewed At 6 May 2016, <Https://Www.Jbhifi.Com.Au/Documents/Announcements/JB_Hi-Fi_Limited_Prospectus.Pdf>

JB HI-FI Annual Report 2015, Viewed 4 May 2016, <Https://Www.Jbhifi.Com.Au/General/Corporate/Consumer-Matters/About-Us/>.

Harvey Norman Annual Report 2016, Viewed 4 May 2016, <Http://Www.Harveynormanholdings.Com.Au/Pdf_Files/2015-Annual-Report.Pdf>.

Mackay, A. 2005, A Practitioner's Guide To The Balanced Scorecard, Chartered Institute Of Management Accountants, Viewed At 4 May 2016,

<Http://Www.Gslb.Cimaglobal.Com/Documents/Thought_Leadership_Docs/Tech_Resrep_A_Practitioners_Guide_To_The_B...

Cite this page

Essay Example on Ratio Analysis and Cash Flow Analysis. (2019, Sep 30). Retrieved from https://speedypaper.net/essays/as-can-be-seen-from-the-data-above-the-company-has-been-growing-steadily

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- HRM Essay Sample: Affirmative Action Plan

- What Is the Definition of Love - Essay Example

- Literary Essay Sample on The Color Purple by Alice Walker

- Movie Review in a Free Essay: Skiptrace by Jackie Chan

- IKEA's Marketing in China, Essay Sample

- Movie Review Essay Sample, Free Example

- Essay Sample: Contribution of Sojourner Truth to the Abolitionist Movement

Popular categories