| Type of paper: | Case study |

| Categories: | Accounting |

| Pages: | 3 |

| Wordcount: | 667 words |

Background of the Satyam Scandal

Accounting fraud is the deliberate alteration of financial reports to inflate company's sales or evade debt obligations. Fraud is a frequent occurrence in most organizations, and it is a result of greed, lack of transparency or poor accounting internal controls. Fraud impacts negatively on investors making them lose confidence in a company (Margret & Hoque, 2016). A decrease in investment may contribute to losses or failure in an organization. In 2009, Satyam Computers, an IT company in India, was involved in a scandal whose prime suspects were the founders. Satyam scandal was the biggest fraud ever encountered in India. The fraud was as a result of unethical decisions made by Mr. Ramalinga Raju, the chairman and founder of the company together with his brother. However, the company registered a continuous increase in shareholder value and development.

Correct and Incorrect Balancing

It is until January 2009 that Satyam board of directors learned about the scandal. The chairman disclosed the matter through a written letter to the board. From the revelation, the board found out that Mr. Raju had inflated the company's assets by $1.47 billion (Shirur, 2011). Cash amounting to $1.04 billion claimed to be part of the company's properties was non-existent. For several years, the company inflated income to meet analysts' expectations. For instance, there was 75% inflation in revenues in October 2009. Besides, profit was overstated profits by 97%, and liabilities were underreported in the balance sheet.

Impact of Incorrect Reporting

Fraud did not end at this point since Mr. Raju went ahead and created fake bank accounts to expand the balance sheet with balances that never existed. Also, money from 6000 fake salary accounts was misappropriated upon deposit (Shirur, 2011). In addition, there were illegal loans obtained through forged board resolutions. Therefore, it is evident that the founders of Satyam were not only unethical but also greedy for money. They lacked corporate social responsibility and loyalty to the company. Later, thorough investigations by the Indian investigation agency were done and the fraud dated back to April 1999 when the company registered double-digit growth for the first time. The fraud aimed at increasing profits and raising executive compensation. Some of the funds were also diverted to real estate.

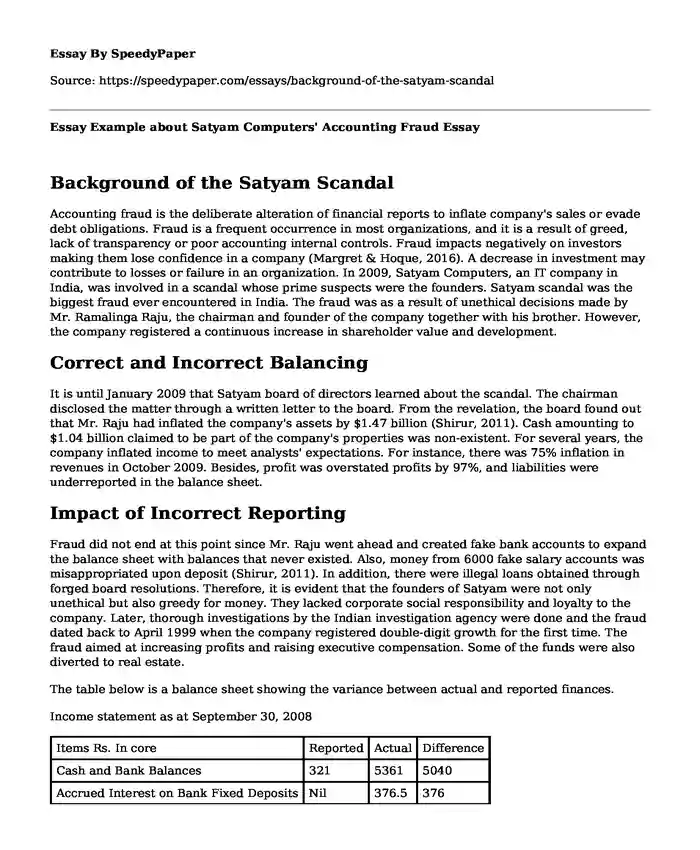

The table below is a balance sheet showing the variance between actual and reported finances.

Income statement as at September 30, 2008

| Items Rs. In core | Reported | Actual | Difference |

| Cash and Bank Balances | 321 | 5361 | 5040 |

| Accrued Interest on Bank Fixed Deposits | Nil | 376.5 | 376 |

| Understated liability | 1230 | None | 1230 |

| Overstated Debtors | 2161 | 2651 | 490 |

| Total | Nil | Nil | 7136 |

| Revenues (Q2 FY 2009) | 2112 | 2700 | 588 |

| Operating profits | 61 | 649 | 588 |

Promoter's shareholding pattern in Satyam from 2001 to 2008

As on Promoter's holding 1%

March 2001 25.6

2002 22.26

2003 20.74

2004 17.35

2005 15.67

2006 14.02

2007 8.79

2008 8.74

Dec. 2008 2.18

The Reasoning Used by The Managers to Support the Incorrect Reporting

After revelation of the scandal, Merrill Lynch ended its engagement with Satyam while PricewaterhouseCoopers (PWC) revoked their license of operation. Besides, the news of the scandal led to anxiety in the Indian stock market. Mr. Raju was charged with forgery and breach of trust. PWC was however blamed for the scandal that occurred for a long period without detection despite the regular audit of their financial statements (Saha, 2016). Nevertheless, new board members were appointed to prevent the firm from collapsing. In mid-march, investors started developing confidence in the company.

Stock Charting of Satyam from December 2008 to January 2009.

Potential Private Motivations And/or Incentives for Managers to Adopt The Incorrect Reporting

Mr. Raju falsified revenue figures since it was difficult to alter with expenditures. As a result, the difference between actual profits and those recorded in books widened each year. He went ahead and acquired Maytas infrastructure to reduce that gap. Therefore, auditing firms were to blame for the fraud that could not be revealed for a long period.

References

Margret, J., & Hoque, Z. (March 01, 2016). Business Continuity in the Face of Fraud and Organisational Change. Australian Accounting Review, 26, 1, 21-33.

Saha, S. S. (2016). Corporate accounting scandals: Select case studies across the globe.

Shirur, S. (July 01, 2011). <i>Tunneling vs Agency Effect: A Case Study of Enron and Satyam</i>. Vikalpa, 36, 3, 9-20.

Cite this page

Essay Example about Satyam Computers' Accounting Fraud. (2022, Sep 23). Retrieved from https://speedypaper.net/essays/background-of-the-satyam-scandal

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- The Fisher King - Free Essay on the Hero's Journey

- Free Essay Example: Counter-terrorism for First Responders

- The Judge's Wife - Isabel Allende | Essay Sample

- Essay Sample: Without Ratification, Women's Rights in The Workforce

- Essay Example on Story of My Body

- Journey Through Hell. Free Essay Example

- Paper Example. Political Influence on Law

Popular categories