| Type of paper: | Essay |

| Categories: | Tax system |

| Pages: | 6 |

| Wordcount: | 1614 words |

The federal government of Austria has well-elaborated jurisdiction to the tax residents on some of the income which is derived from the worldwide sources and that which is derived from nonresidents of the country. The Austria legislation's known for very s specific rules which relate to the residency. These specific rules are used to determine whether an individual or given company is considered a resident for tax purposes.

A: the tax code

As explained by Stieglitz, & Rosengard, (2015), the Austria tax law is created by statute. In light of this, its key sources mail lies in the legislation. The legislation n is normally theca of parliament. The cases are normally decided upon by the tribune courts. Sometimes the tax ruling is done by the commoners of taxation. The constitution of the country distribute the taxing rights of the income tax. The income tax in the country is imposed by the federal government. It is imposed on the taxable income of individual and corporation.

B: Guideline and interpretation

One of the components of the income tax into the country is the existence of the personal income tax. This kind of tax is considered to be a progressive tax. They comprise of the tax rate as for the individual's taxpayers who are normally differentiated from the nonresident tax pays. Currently, in the country, the tax-free threshold for the country is at $11,000. The marginal rate of personal income tax is recorded at 55% to the highest side (Markle,2016).

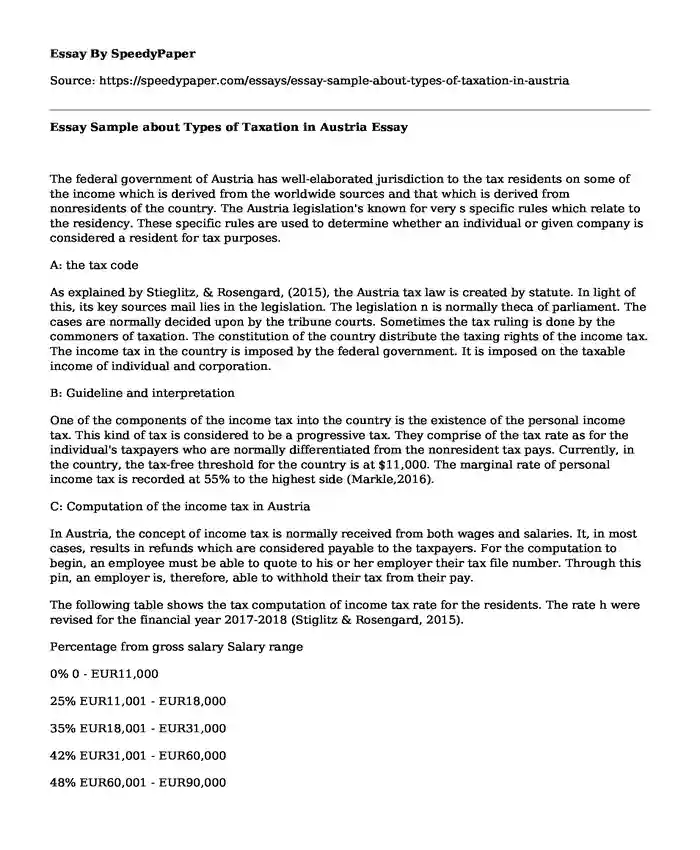

C: Computation of the income tax in Austria

In Austria, the concept of income tax is normally received from both wages and salaries. It, in most cases, results in refunds which are considered payable to the taxpayers. For the computation to begin, an employee must be able to quote to his or her employer their tax file number. Through this pin, an employer is, therefore, able to withhold their tax from their pay.

The following table shows the tax computation of income tax rate for the residents. The rate h were revised for the financial year 2017-2018 (Stiglitz & Rosengard, 2015).

Percentage from gross salary Salary range

0% 0 - EUR11,000

25% EUR11,001 - EUR18,000

35% EUR18,001 - EUR31,000

42% EUR31,001 - EUR60,000

48% EUR60,001 - EUR90,000

50% EUR90,001 - EUR1,000,000

55% Over EUR1,000,000

D: a group of taxpayers who should pay income tax in Austria

Income tax in the country is paid by Austria residents, foreign residents and those whose residency has changed during the year. For the Austria residents, one must be able to declare all his or her income which has been earned anywhere in the world for the foreign residents who are working in the country one is requited to declare their tax income and employment income rental income and the capital gains on the Austria assets. In the country, there is as a segment for the income for minors. These are individuals who are below eighteen years of age. They are taxed differently from adults (Mares & Queralt,2015).

E: income tax report in Austria

The major companies on income tax in the country include; income from salary. His particular component comprises of salary, leave encasements and allowances. The second company is the income which is gotten from the house property. It comprises of income firm one house. This house could be self-occupied, vacant or could be rented. The third comp net is the income which is received from the capital gains. This majorly comprises of the income from the sale of the capital assets. The fourth component is the income which is derived from business and profession. This component comprises of the income or the loss that is seen to be as rising from carrying on particular business or profession. Finally, it could also comprise of income which is gotten from other sources. This will be counted as the residual head, income which has been derived from a bank account and income which could be received from fixed deposits and the family pension(Jaimovich & Rebelo,2017).

F: sample of an income tax report in Austria

https://home.kpmg.com/xx/en/home/insights/2011/12/austria-income-tax.html#01G: other related information

Some of the items which are seen to be reducing taxable income in the country include; fist, there is the aspect of personal expenses. These could be expenses which are not in any way related to the income of particular sources. They include elements such as voluntary health, life insurance policies and accidents. The second a spect which reduce the taxable income of an individable in Austria is expenses which are incurred by a taxpayer as a result of extra ordinary circumstances. These expenses are normally deducted from the taxable income (Knoester,2016).

Table one : the tax code

As explained by Stieglitz, & Rosengard, (2015), the Austria tax law is created by statute. In light of this, its key sources mail lies in the legislation. The legislation n is normally theca of parliament. The cases are normally decided upon by the tribune courts. Sometimes the tax ruling is done by the commoners of taxation. The constitution of the country distribute the taxing rights of the income tax. The income tax in the country is imposed by the federal government. It is imposed on the taxable income of individual and corporation.

Table two: Guideline and interpretation

One of the components of the income tax into the country is the existence of the personal income tax. This kind of tax is considered to be a progressive tax. They comprise of the tax rate as for the individual's taxpayers who are normally differentiated from the nonresident tax pays. Currently, in the country, the tax-free threshold for the country is at $11,000. The marginal rate of personal income tax is recorded at 55% to the highest side.

Table three: Computation of the income tax in Austria In Austria, the concept of income tax is normally received from both wages and salaries. It, in most cases, results in refunds which are considered payable to the taxpayers. For the computation to begin, an employee must be able to quote to his or her employer their tax file number. Through this pin, an employer is, therefore, able to withhold their tax from their pay.

The following table shows the tax computation of income tax rate for the residents. The rate h were revised for the financial year 2017-2018.

Percentage from gross salary Salary range

0% 0 - EUR11,000

25% EUR11,001 - EUR18,000

35% EUR18,001 - EUR31,000

42% EUR31,001 - EUR60,000

48% EUR60,001 - EUR90,000

50%EUR90,001 - EUR1,000,000

55% Over EUR1,000,000

Table four: a group of taxpayers who should pay income tax in Austria

Income tax in the country is paid by Austria residents, foreign residents and those whose residency has changed during the year. For the Austria residents, one must be able to declare all his or her income which has been earned anywhere in the world for the foreign residents who are working in the country one is requited to declare their tax income and employment income rental income and the capital gains on the Austria assets. In the country, there is as a segment for the income for minors. These are individuals who are below eighteen years of age. They are taxed differently from adults.

Table five: : income tax report in Austria

The major companies on income tax in the country include; income from salary. His particular component comprises of salary, leave encasements and allowances. The second company is the income which is gotten from the house property. It comprises of income firm one house. This house could be self-occupied, vacant or could be rented. The third comp net is the income which is received from the capital gains. This majorly comprises of the income from the sale of the capital assets. The fourth component is the income which is derived from business and profession. This component comprises of the income or the loss that is seen to be as rising from carrying on particular business or profession. Finally, it could also comprise of income which is gotten from other sources. This will be counted as the residual head, income which has been derived from a bank account and income which could be received from fixed deposits and the family pension.

Table six: Sample

https://home.kpmg.com/xx/en/home/insights/2011/12/austria-income-tax.html#01Table seven: other related information

Some of the items which are seen to be reducing taxable income in the country include; fist, there is the aspect of personal expenses. These could be expenses which are not in any way related to the income of particular sources. They include elements such as voluntary health, life insurance policies and accidents. The second a spect which reduce the taxable income of an in dividable in Austria is expenses which are incurred by a taxpayer as a result of extra ordinary circumstances. These expenses are normally deducted from the taxable income.

Reference

Barbara, C., Jones, M., Korac, S., Saliterer, I., & Steccolini, I. (2017). Governmental financial resilience under austerity in Austria, England and Italy: How do local governments cope with financial shocks?. Public Administration, 95(3), 670-697.

Jaimovich, N., & Rebelo, S. (2017). Nonlinear effects of taxation on growth. Journal of Political Economy, 125(1), 265-291.

Knoester, A. (Ed.). (2016). Taxation in the United States and Europe: Theory and Practice. Springer.

Mares, I., & Queralt, D. (2015). The non-democratic origins of income taxation. Comparative Political Studies, 48(14), 1974-2009.

Markle, K. (2016). A Comparison of the TaxMotivated Income Shifting of Multinationals in Territorial and Worldwide Countries. Contemporary Accounting Research, 33(1), 7-43.

O'connor, J. (2017). The fiscal crisis of the state. Routledge.

Steiner, V., & Wakolbinger, F. (2015). Tax Reform 2015-16 and Bracket Creep 2010-2019. A Microsimulation Analysis for Austria. WIFO Monatsberichte (monthly reports), 88(5), 425-430.

Stiglitz, J. E., & Rosengard, J. K. (2015). Economics of the Public Sector: Fourth International Student Edition. WW Norton & Company.

Cite this page

Essay Sample about Types of Taxation in Austria. (2022, May 20). Retrieved from https://speedypaper.net/essays/essay-sample-about-types-of-taxation-in-austria

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay about the Contribution of International Trade

- Application Letter Example

- Effects of Students Dropping out of High School, Education Essay Sample

- Free Essay Comprising Ocado Group Financial Report

- An Album Review Essay Sample of the Studio Album, ''Hotel California'' By the Eagles

- Personal Critical Incident Paper, Free Example

- Free Essay Evaluating Community Nursing Research

Popular categories