| Type of paper: | Essay |

| Categories: | Finance Business Analysis |

| Pages: | 6 |

| Wordcount: | 1422 words |

Financial Ratios

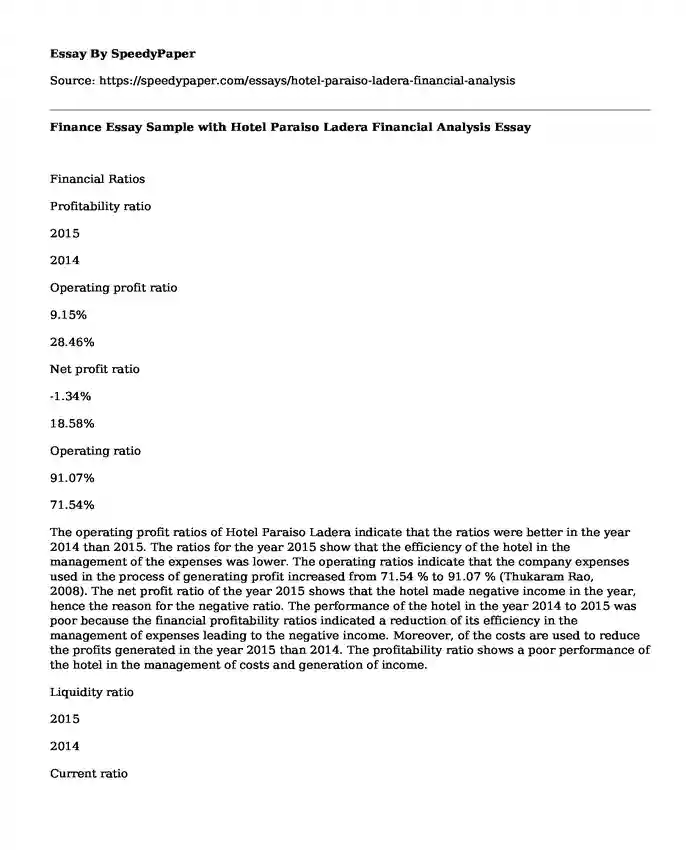

Profitability ratio

2015

2014

Operating profit ratio

9.15%

28.46%

Net profit ratio

-1.34%

18.58%

Operating ratio

91.07%

71.54%

The operating profit ratios of Hotel Paraiso Ladera indicate that the ratios were better in the year 2014 than 2015. The ratios for the year 2015 show that the efficiency of the hotel in the management of the expenses was lower. The operating ratios indicate that the company expenses used in the process of generating profit increased from 71.54 % to 91.07 % (Thukaram Rao, 2008). The net profit ratio of the year 2015 shows that the hotel made negative income in the year, hence the reason for the negative ratio. The performance of the hotel in the year 2014 to 2015 was poor because the financial profitability ratios indicated a reduction of its efficiency in the management of expenses leading to the negative income. Moreover, of the costs are used to reduce the profits generated in the year 2015 than 2014. The profitability ratio shows a poor performance of the hotel in the management of costs and generation of income.

Liquidity ratio

2015

2014

Current ratio

0.018182

0.311594

Quick ratio

0.00

0.28

The hotel has a performance that is below expectation in the liquidity ratios. The ratios were better in the year 2014 than the year 2015. The current ratio shows that the current hotel liabilities are far much higher than the current assets hence the ability to meet expense when due is poor. The worsening of the liquidity ratios indicates that the business financial ability is becoming poorer. The current ratios show that the hotels management is poor in the management of the working capital. There is a high possibility the hotel faces challenges of cash flows with higher outflows than the inflows. The quick ratios indicate that the hotels ability to convert the current assets into cash was becoming weak in the year 2015 as compared to the year 2014. The expected quick ratio should be an average of 1 that would mean all the obligation can be met by the current ratios when they become due. The failure of the current asset to meet all the current liabilities when they are due may mean that the hotel needs to take measures of controlling the challenge at an early stage before the difficulties in meeting creditors demand increase. The current ratios are expected to have an average of 1.2 (Lee, Lee, & Lee, 2013).

Solvency ratio

2015

2014

Debt to equity

0.577132

0.403441

Fixed assets to equity ratio

1.574311

1.384946

Debt ratio

0.365988

0.287466

Interest Coverage

0.891304

4

The solvency ratios indicate that the hotel is financed by both equity and debt capital. The debt capital is low with almost half when compared to the equity capital. The amount of debt capital increased in the year 2015 as compared to the year 2014. The increase in the debt ratio is shown by the growth of debt ratio and debt equity ratio. The increase in the debt capital indicates that the hotel still has room for borrowing and it is credit worth to investors and other creditors. The interest coverage ratio is reduced from 4 in the year 2014 to 0.89 in the year 2015. The reduction in the ratios indicates that the hotel covering in the financial expenses is becoming worse. The decrease in the interest coverage ratios shows that the hotels ability to pay the interest when due id reducing. It is a dangerous trend for the hotel since further reduction may mean it will not be able to meet the needs of the financiers who may request for the liquidation of the hotel or confiscation of some property used to secure the finances provided.

Evaluation of the purchase price

The hotel is facing a hard financial time. The financial ratios indicate that the company has a poor performance in overall. The maintenance of the working capital is weak, and the company may have difficulties in the implementation of the budget in the market if the management does not take different measure that would safeguard its position in the market. The reason for the hotel being sold may be caused by the continuous poor performance that seems to continue worsening in the year 2015. Depending on the figures given, the performance of the hotel can improve with proper management and aggressive sales. The selling price of the hotel of 2.8m is reasonably fair in the light of the level of debt and the assets owned. The total assets to liabilities indicate that the assets are more than the liabilities, meaning that the company is in a position of having higher net worth. Though the current assets are less than the current liabilities, the long-term assets are quite high, and they suppress the deficit caused by the fewer current assets. The fixed assets as compared to the equity capital are high, and therefore, the price set for the hotel is not unreasonable. The rental income projected over the period seems attractive for an investor since the payback period of the investment would be relatively low. Assuming the best business performance, it would take only one season for the business to recover the capital invested. The cash flow per season is attractive for an investor considering the business is long term its location. For example, assuming that the all the weeks in a season are utilized, and all apartments are occupied, the cash flow of the season is high and hence the price of the purchase considering the figure given is acceptable.

Other considerations before investing

In order to have a firmer decision on whether to buy or not, it is important for Sarah & Warwick Phillips to ensure that they assess whether any other related costs and regulations may affect the acquisition. It is necessary to look into the government regulations concerning the transfer and trading of the business in Malaga. The tax rates for trading in Spain are also an appropriate consideration to determine how the government taxes would affect the business. It is also important for the group to consider the local authorities effect on business in Malaga and the associated costs such as land and property rates, licenses and other regulatory costs. They should assess their knowledge and skills of managing the apartments to convert it into a profit making business. For the organization to makes profits, they need to have the expertise that would enable them to change the current fortunes of the company into a profitable business (Thukaram Rao, 2008). An excellent study of the local market and the trends needs to be considered to ensure that Sarah & Warwick Phillips and determines independently that provided figures by the current management of the business are true. The study of the firm in the local market also gives the team a good ground to assess if the business meets their expected investment. It is also important for the teams to consider the costs associated with the acquisition process of the business such as the cost of legal fee and clerical work. The costs are an important consideration to know the ultimate cost of the business. The past image of the business is an important factor in making a decision on whether to purchase the business at the priced value. When buying business one can pay more than the real value on condition that business has a good public image. If the business has a bad public image, it would be a risky purchase.

Recommendations

I would recommend Sarah & Warwick Phillips to find out if they can change the fortune of the hotel before they purchase. The reason for the hotel making losses and its financial fortunes worsening needs a careful study before purchasing the business. They should find out the reasons for the poor performance of the business for the last two years and assess the impacts on the business. I would also recommend they seek legal advice on the procedures and process of acquiring the business. The process of acquisition if it acceptable to them should include all the necessary disclaimers that prevent them from acquiring other business liabilities that are not stated during the time of the purchase (Butler, 2008). They should also communicate with the current auditors of Hotel ParaisoLaderais to ascertain if the presented financial statements are true and fair. They should make it clear to the auditors that they wish to purchase the business and request for any additional information that is deemed necessary.

References

Butler, S. (2008). The lawyer's guide to buying, selling, merging, and closing a law practice. Chicago, IL: American Bar Association.

Lee, C., Lee, J., & Lee, A. (2013). Statistics for business and financial economics. New York, NY: Springer.

Thukaram Rao, M. (2008). Management Accounting (2nd ed.). New Delhi: New Age.

Cite this page

Finance Essay Sample with Hotel Paraiso Ladera Financial Analysis . (2017, Sep 04). Retrieved from https://speedypaper.net/essays/hotel-paraiso-ladera-financial-analysis

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay Sample on Personal Effectiveness

- Organizational Violence, Free Essay

- Preparing Serial Dilutions of Soil Bacteria, Free Lab Report Example

- XM and Sirius Radio, Business Essay Example

- Free Essay Describing Mental Disorders Case Studies

- Computer Science Essay Example: New Authentication Proposal

- Free Essay Example: Types of Business Organization

Popular categories