| Type of paper: | Business plan |

| Categories: | Budgeting Financial analysis |

| Pages: | 4 |

| Wordcount: | 956 words |

The purpose of this paper is to provide a five-year financial plan for IKEA. The research involves the costs, cash flows, financial statements, and risks associated with the IKEA project. Financial planning is the process of developing monetary policies regarding investment and funding of an enterprise. Financial planning determines the capital structure depending on the capital requirements and then develops funding policies accordingly. Financial planning is crucial for every project. It helps in ensuring the provision of adequate funds, helps in reducing risks and assists a firm in achieving stability by balancing outflows with inflows. Below is an analysis of IKEA financial plan.

Start-up capital requirements

The company plans to sell a wide range of products. They include baby furniture, kitchen furniture, lighting & decorations, cooking & accessories, beds & mattresses, bathroom & laundry, open shelving & storage, textiles & rugs, and outdoor furniture just a few to mention. Some of the intended services are flat packaged food, delivery services, assembly services, free kitchen & bathroom installation, removal and recycling services, sewing services, restaurant, and children's services. The company aims at opening production and retails stores. About 1000 employees will work in the company. Ideally, the project requires about $10billion to complete.

Sources of financing

The primary source of funding for the project is venture capital. IKEA will generate high incomes since the potential growth in the industry is very high. The company will utilize technology to serve customers in the market. Therefore the project qualifies to acquire venture capital. Another source of funding for this project is the bank loans. The with a potential to accumulate wealth very fast after the completion of the project, the banks are willing to cooperate and offer funds to facilitate the project. Government grants and subsidies cannot be left behind. The project promises to generate a lot of revenue to the government and thus secures its position in acquiring the donations from the government.

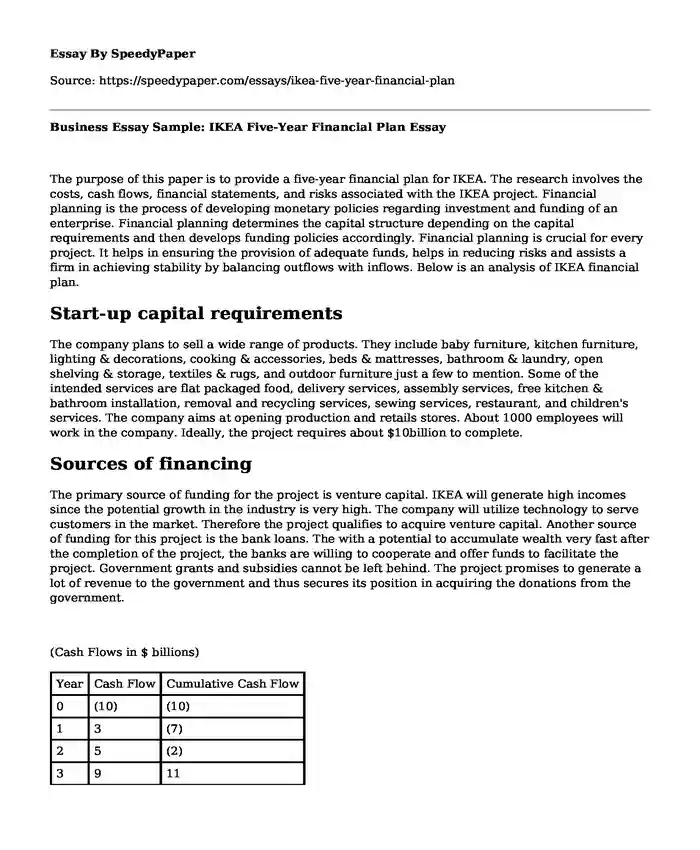

(Cash Flows in $ billions)

| Year | Cash Flow | Cumulative Cash Flow |

| 0 | (10) | (10) |

| 1 | 3 | (7) |

| 2 | 5 | (2) |

| 3 | 9 | 11 |

| 4 | 15 | 26 |

| 5 | 20 | 46 |

Payback period

Payback period is the time expected to recover the initial expenditure of an enterprise from the cash inflows (Lefley 2014). The project has an initial investment of $10billion and is required to make $3billion in the first year, $5billion in the second year, $9billion in the third year, $15billion in the fourth year and $20billion in the fifth year. Therefore the payback period consists of uneven cash flows. Below is the calculation of the payback period.

= 2 + (2/9)

= 2 + 0.22

= 2.22 years

Cash flow Projections in $ millions

| YEAR | 5 | 4 | 3 | 2 | 1 |

| Cash Flows from Operating Activities Net loss | (190,201) | (151,046) | (142,721) | (122,924) | (104,120) |

| Adjustments to reconcile Net loss to Net cash provided by Operating Activities Depreciation | 410,010 | 362,223 | 323,777 | 284,817 | 245,640 |

| Stock-based compensation expense | 400,214 | 381,203 | 342,569 | 293,416 | 264,123 |

| Other | 11,789 | 12,370 | 13,067 | 4,901 | 3,893 |

| Deferred income taxes | 14,206 | 13,002 | 1,806 | 1,784 | 1,713 |

| Foreign currency transaction (gain) loss | 33,658 | 24,560 | 14,461 | 12,032 | 1,920 |

| Changes in Operating Assets and Liabilities Accounts receivable, net | (294,301) | (262,902) | (213,616) | (165,784) | (103,912) |

| Inventories | (825,617) | (754,223) | (703,412) | (662,318) | (611,040) |

| Accounts payable & accrued expenses | 755,201 | 734,400 | 623,930 | 592,219 | 551,402 |

| Accrued compensation | 34,206 | 23,809 | 22,061 | 11,910 | 10,420 |

| Deferred revenue | 54,426 | 53,132 | 42,320 | 41,619 | 30,994 |

| Other liabilities | 24,002 | 14,601 | 13,010 | 1,720 | 1,540 |

| Net Cash provided by Operating Activities | 427,593 | 451,129 | 337,252 | 293,392 | 292,573 |

The projected balance sheet at the end of the first year in $ millions

IKEA BALANCE SHEET FOR YEAR 1

Assets Amount Liabilities & Capital Amount

Current Assets Current Liabilities Cash 180,416 Accounts Payable 551,402

Accounts Receivable 103,912 Notes Payable 30,994

Inventory 611,040 Subtotal 582,396

Other 3,893 Long-term Liabilities 98,265

Subtotal 899,261 Total Liabilities 484,131

Long-term Asset Capital Furniture 264,123 Earnings 171,729

Subtotal 264,123 Retained earnings 156,780

Less Accumulated Operation 120,602 Paid-in Capital 230,142

Subtotal 143,521 Total Capital 558,651

Total Assets 1,042,782 Total Liabilities & Capital 1,042,782

IKEA INCOME STATEMENT AT THE END OF YEAR 1

Sales revenue 2,646,788

Cost of goods sold 1,611,040

Gross profit 1,035,748

Pre-tax income 611,040

Income tax 1,713

Net income 609,327

The projected income statement at the end of year one in $ millions

Chart representation of Sales revenue, gross profit, and net income

Break-even analysis

Break-even analysis is a method used to differentiate and categorize fixed and variable costs (McGee, 2015). The technique involves comparing total fixed costs, and total variable costs to establish the point at which the enterprise makes neither loss nor profit. It is mostly applicable to production management.

Break-Even Analysis in $

YEAR

PRODUCT 1 2 3 4 5

Price per unit 130 140 150 160 170

Variable cost 45 55 60 75 90

Margin per unit 85 85 90 85 80

Sales mix percentage 25% 35% 45% 55% 65%

21.25 29.75 40.5 46.75 52

Sum: Average CM per Unit 38.05

Fixed cost 4,000, 000

Beak-even number of units to sell 1,200 4,700 9,223 10,415 18,201

Product sales 156,000 658,000 1,383,450 1,666,400 3,094,170

Sum: Break-Even Product Sales 6,958,020

Ratio Analysis (Inventory Turnover Ratio)

Inventory turnover ratio is a ratio that indicates inventory management through comparison of the goods sold with the average inventory for a certain period (Rao & Rao 2009). It measures the number of times the average stock trades in a particular time.

Inventory ratio = cost sold goods

Average inventory

The project promises to generate a total of $52billion in within five years while the average stock is $6,958,020 million. Therefore;

Inventory ratio = $52 billion/ $600,958,020 million

= 52,000,000,000/ 600,958,020

= 86.53

Risks associated with the project

Executive support

The executive may fail to be consistent and committed to the project and thus leading to the failure. This risk is essential since it helps in choosing the best executive to implement the plan.

Change management

Change management may portray the project 's failure due to a lot of budget and time manipulations. This risk helps in hiring competent managers who will manage the project most effectively.

Resources and team

The funds may reduce, and thus it becomes difficult to complete the project. Also, hiring staff which has less or no skills and knowledge may lead to misuse of resources. This risk helps the project managers to search for the best suppliers and experienced workers.

Procurement

There is a possibility that RFP may not be acceptable. Also, vendors may fail to deliver to the terms of the contract. This risk helps the project managers to source for multiple suppliers who can supply anytime.

References

Lefley, F. (2014). The payback method of investment appraisal: a review and synthesis. International Journal of Production Economics, 44(3), 207-224.

McGee, J. (2015). BreakEven Analysis. Wiley Encyclopedia of Management, 1-1.

Rao, C. M., & Rao, K. P. (2009). Inventory turnover ratio as a supply chain performance measurement. Serbian Journal of Management, 4(1), 41-50.

Cite this page

Business Essay Sample: IKEA Five-Year Financial Plan. (2022, Oct 18). Retrieved from https://speedypaper.net/essays/ikea-five-year-financial-plan

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Example on Biotic and Abiotic Factors in an Ecosystem

- Using Wikipedia as a Source - Free Essay for Students

- Essay Sample: Cloud Computing Security, Reliability, and Availability

- Comparison Essay Sample: The Views of Native Americans and African Religions on Nature

- Free Essay with a Discussion of Drugs and Society with a Focus on Marijuana Use

- Essay Sample about Opting for Majors

- Free Essay Example: English Film Theory

Popular categories