| Type of paper: | Case study |

| Categories: | Tax system Money Accounting |

| Pages: | 2 |

| Wordcount: | 411 words |

Taxable income refers to the income used to calculate tax. Income tax is derived from the provision of itemized deductions and all exemptions for the adjusted gross income. John's gross estate and the gross assets after six months are provided as $8,525,000 and $9,050,000 respectively.

Estate Tax Base= Taxable estate-Gifts after 1976=$8,250,000-$0=$8,250,000What is the amount of estate tax owed if the tentative estate tax (before credits) is $3,235,800?

Response

Tentative estate tax is $3,235,800Estate tax owed=computed estate taz less unified tax credit for 2019=$3,235,800-$2,125,800=$1,110,000=the unified tax credit is $11.18 million indicating that John'sestate has no estate taxes due as the estate is less than the specified amounts. 4. Alternatively, if, six months after his death, the gross assets in John's estate declined in value to $7,500,000, can the administrator of John's estate elect the alternate valuation date? What are the crucial factors that the administrator should consider as to whether the alternative valuation date should be selected?

In the case that John's gross estate value decreased in the six months to $7,500,000, the law provides that the administrator selects an alternative date on which the assets may be valued. The essential factors for the administrator to consider while determining the alternative date include:

Deciding the alternative date of valuation well in advance that the saved estate taxes are highest

The transaction's impact on the valuation benefactor should be determined based on the income tax situation

Part 2

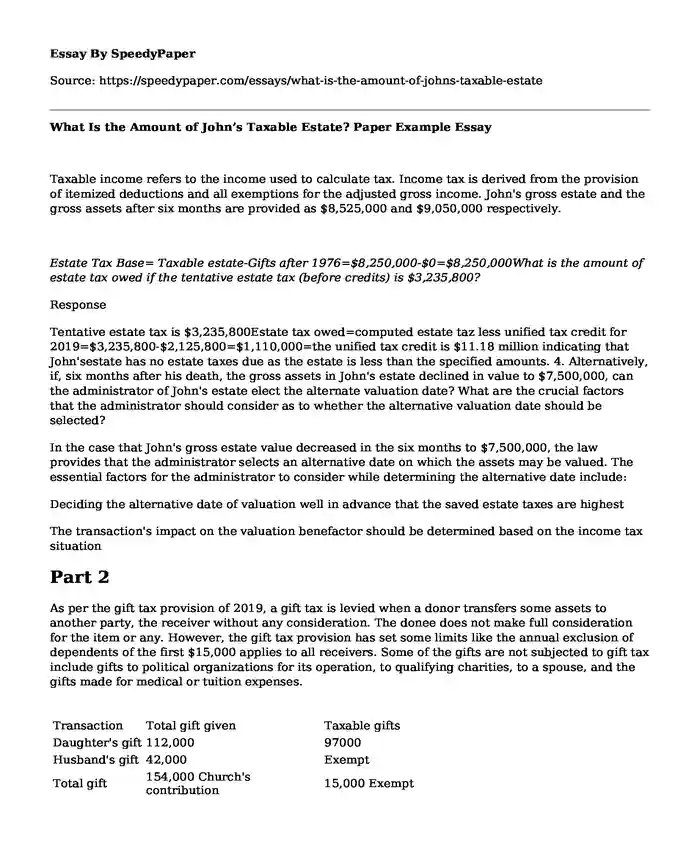

As per the gift tax provision of 2019, a gift tax is levied when a donor transfers some assets to another party, the receiver without any consideration. The donee does not make full consideration for the item or any. However, the gift tax provision has set some limits like the annual exclusion of dependents of the first $15,000 applies to all receivers. Some of the gifts are not subjected to gift tax include gifts to political organizations for its operation, to qualifying charities, to a spouse, and the gifts made for medical or tuition expenses.

| Transaction | Total gift given | Taxable gifts |

| Daughter's gift | 112,000 | 97000 |

| Husband's gift | 42,000 | Exempt |

| Total gift | 154,000 Church's contribution | 15,000 Exempt |

| Total | 169,000 | 97000 |

The gift made to the daughter is taxable with an annual exclusion of $15,000 for the dependents. The church's donation is not taxable as a gift considering that it is made to a qualifying charity (church). The gift to husband ($40,000) is not taxable as it is gifted to a spouse, which is not subject to any tax for the level. The taxable gifts for the year 2020 are thus $97,000.

Cite this page

What Is the Amount of John's Taxable Estate? Paper Example. (2023, Apr 24). Retrieved from https://speedypaper.net/essays/what-is-the-amount-of-johns-taxable-estate

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Job Performance and Class Performance, Free Essay Sample

- Free Essay Example on Exponential Growth and Moore's Law

- Essay Sample on Company Registration in the UK and Germany

- Essay Sample: Graduate Level Psychology Discussion Post

- Free Essay Providing the Analysis of Zora Neale Hurston's Novel, Their Eyes Were Watching God

- Essay Example: Powered Industrial Truck Standard

- Controversy Associated with Drug Prices - Essay Sample

Popular categories