| Type of paper: | Essay |

| Categories: | Financial analysis |

| Pages: | 6 |

| Wordcount: | 1551 words |

Financial analysis is a concept that seeks to explain the financial position of a company through the calculation of its financial ratios (Dursun, Cemil, & Uyar, 2013). There are two kinds of financial analysis; financial growth, and industry position. In most cases, managers are usually more interested in the financial growth of the company while investors are usually keener on the industry position of the company. Therefore, in determining the base of comparison of the financial ratios, it is usually important to identify the person to whom one is reporting to (Dursun, Cemil, & Uyar, 2013). When conducting a financial growth analysis, the basis of comparison is usually the progressive years of the company. The growth of a company usually indicates the position of the company in its life cycle (Dursun, Cemil, & Uyar, 2013). Slow growth usually indicates infancy of a company, steep growth indicates midlife of the company, and a plateau indicates maturity. Financial ratios are relationships between different transactional information as transacted by the company in the conduct of its normal business. The purpose of this study is to determine the financial growth of Prudential Financial Incorporated as has been witnessed for the period between 2013 and 2014.

Company Overview

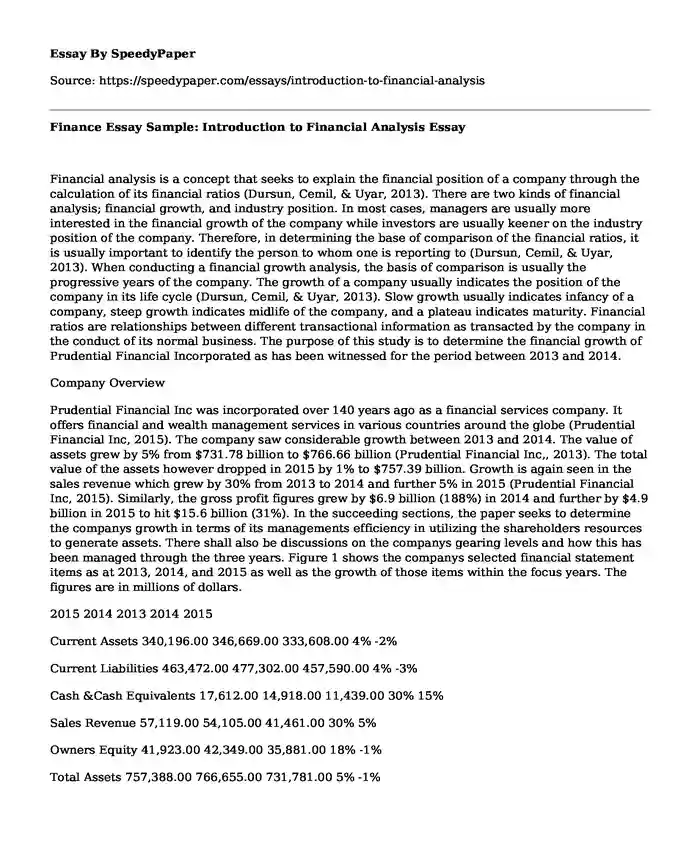

Prudential Financial Inc was incorporated over 140 years ago as a financial services company. It offers financial and wealth management services in various countries around the globe (Prudential Financial Inc, 2015). The company saw considerable growth between 2013 and 2014. The value of assets grew by 5% from $731.78 billion to $766.66 billion (Prudential Financial Inc,, 2013). The total value of the assets however dropped in 2015 by 1% to $757.39 billion. Growth is again seen in the sales revenue which grew by 30% from 2013 to 2014 and further 5% in 2015 (Prudential Financial Inc, 2015). Similarly, the gross profit figures grew by $6.9 billion (188%) in 2014 and further by $4.9 billion in 2015 to hit $15.6 billion (31%). In the succeeding sections, the paper seeks to determine the companys growth in terms of its managements efficiency in utilizing the shareholders resources to generate assets. There shall also be discussions on the companys gearing levels and how this has been managed through the three years. Figure 1 shows the companys selected financial statement items as at 2013, 2014, and 2015 as well as the growth of those items within the focus years. The figures are in millions of dollars.

2015 2014 2013 2014 2015

Current Assets 340,196.00 346,669.00 333,608.00 4% -2%

Current Liabilities 463,472.00 477,302.00 457,590.00 4% -3%

Cash &Cash Equivalents 17,612.00 14,918.00 11,439.00 30% 15%

Sales Revenue 57,119.00 54,105.00 41,461.00 30% 5%

Owners Equity 41,923.00 42,349.00 35,881.00 18% -1%

Total Assets 757,388.00 766,655.00 731,781.00 5% -1%

Gross profit 15,580.00 10,711.00 3,717.00 188% 31%

Net Income 7,769.00 1,759.00 (1,684.00) -204% 77%

Total Liabilities 715,465.00 724,306.00 695,900.00 4% -1%

Liquidity Ratios

Liquidity ratios are those ratios that seek to determine the companys liquidity position. Liquidity seeks to ascertain how efficiently the company can cover its short term liabilities using its short term assets. It is the measure of the ability of the company to meet its short term obligations as and when they arise in cases of emergencies (Dursun, Cemil, & Uyar, 2013). There are two particular ratios that this paper focuses on; the liquidity ratio (the ratio between the current assets and the current liabilities), and the cash ratio (the ratio between the cash & cash equivalents value and the value of the current liabilities). The objective of these ratios is to determine the companys margin of safety (Dursun, Cemil, & Uyar, 2013).

Liquidity ratio = liquid assets short term liabilities

Liquidity Ratio 2015 = 340,196.00 463,472.00 = 0.73

Liquidity Ratio 2014 = 346,669.00 477,302.00 = 0.73

Liquidity Ratio 2013 = 333,608.00 457,590.00 = 0.72

The companys overall liquidity has remained constant through the three years. Where the ratio is less than 1, it means that it cannot meet its short term obligations through the liquidation of its current assets. This means that, slightly over 30% of its short term liabilities shall remain unpaid should an emergency arise to meet its short term obligation. Given the nature of the company, this is risky as most of its short term obligations are based on financial instruments of its clients. Therefore, in case of a run on the financial services industry, the company is particularly placed in a risky position.

Cash Ratio = Liquid cash equivalents short term liabilities

Cash ratio 2015 = 17,612.00 463,472.00 = 0.04

Cash ratio 2015 = 14,918.00 477,302.00 = 0.03

Cash ratio 2015 = 11,439.00 457,590.00 = 0.02

This ratio is usually not used by analysts when analyzing the overall financial position of the company. This is because it is usually unrealistic for businesses to maintain high levels of liquid cash. However, the nature of this organization, being more of a financial services company, and the rise in the risk of clients to run on financial institutions, the underlying risk of the company not being able to meet its cash requirements in such a situation is necessary. The cash ratio shows the likelihood of a company to be unable to meet its short term liabilities in cash. From the analysis of the company, the cash to current liability ratio is relatively high, this means that the company is at risk of not meeting its short term obligations in cash should the need arise.

Efficiency Ratios

Efficiency ratios are used to assess the managements efficiency to use the resources that have been bestowed upon them to generate revenue (Dursun, Cemil, & Uyar, 2013). It is a management performance indicator that signifies the direction that the company should take as regards the directors of the company. In our particular case study, the efficiency ratios can be used to ascertain the compensation payable to the directors. Also, the efficiency ratios usually indicate the risk behavior of the management. Very risky financial decisions in the aim of generating revenue are usually encouraged in the case of wealth management companies. This is because; the overall objective of the company is usually to maximize the wealth of its clients.

Rate of Asset Turn over = Total sales revenue Total asset base

Asset Turnover Ratio 2015 = 57,119.00 757,388.00 = 0.08

Asset Turnover Ratio 2014 = 54,105.00 766,655.00 = 0.07

Asset Turnover Ratio 2013 = 41,461.00 731,781.00 = 0.06

The Rate of asset turnover indicates the efficiency of the management to generate revenue from the existing assets at their disposal. The assets include fixed and intangible assets as well as the current assets. Favorable asset turnover moves towards an absolute of 1. The company is not performing well with regards to this efficiency. The utilization of the companys assets to generate sales was not so efficient. However, there is an indication of growing efficiency between the years 2013 to 2014 where the efficiency increased by a cumulative 2 points to settle at 8% in 2015.

Equity Turnover Rate = Sales Owners Equity

Equity Turnover Ratio 2015 = 57,119.00 41,923.00 = 1.36

Equity Turnover Ratio 2014 = 54,105.00 42,349.00 = 1.28

Equity Turnover Ratio 2013 = 41,461.00 35,881.00 = 1.16

This ratio indicates the managements efficiency in utilizing the shareholders contribution to generate income. Favorable ratios are usually above the absolute value of 1. This means the management has over the last three years increased their efficiency in utilizing the shareholders investment to generate revenue. The importance of this ratio is to convince shareholder investors where additional capital is required to fund operations or to expand service delivery.

Working Capital Turnover Rate = Sales (Current Assets Current Liabilities)

Working Capital Turnover Ratio 2015 = 57,119.00 (340,196.00 - 463,472.00) = -0.46

Working Capital Turnover Ratio 2014 = 54,105.00 (346,669.00 - 477,302.00) = -0.41

Working Capital Turnover Ratio 2013 = 41,461.00 (333,608.00 - 457,590.00) = -0.33

Working capital turnover is a ratio that is used to assess the efficiency of the organization to use the working capital to generate revenue. Working capital is usually the difference between the current assets and the current liabilities. It is the amount of funds available at any one given time to the management of the organization to enable the smooth flow of productive work. The company has a negative working capital and hence this cannot be used to practically analyze the performance of the company.

Profitability ratios

Profitability ratios are usually used to calculate the increase in a companys overall assets through the generation of income from utilization of the resources available to grow the assets (Dursun, Cemil, & Uyar, 2013). It is used to analyze the rate at which returns are obtained from the utilization o resource and the utilization of the shareholders funds.

Gross Profit Margin = Gross Profit Sales

Gross Profit Margin 2015 =15,580.00 57,119.00 = 0.27

Gross Profit Margin 2014 =10,711.00 54,105.00 = 0.20

Gross Profit Margin 2013 = 3,717.00 41,461.00 = 0.09

The gross profit margin indicates what composition of the sales value is attributable to profits. It is an indication of the companys performance of increasing revenue while decreasing costs. The gross profit margin for Prudential Financial Inc is at 27%, having grown from 9% in 2013 means that the managements performance has increased by a huge percentage (Prudential Financial Inc,, 2013). The growth seen was due to the increase in revenues without a corresponding percentage increase in administrative expenses.

Return on Equity = Net Income Owners Equity

Return on Equity 2015 =7,769.00 41,923.00 = 0.19

Return on Equity 2014 =1,759.00 42,349.00 = 0.04

Return on Equity 2013 = (1,684.00) 35,881.00 = -0.05

This ratio determines the profitability of the shareholders investments. In the case of Prudential Financial, the profitability of the shareholders investment has grown from a 5% loss to 19% profit (Prudential Financial Inc, 2015). This shows improving financial conditions of the company.

Market Value

These are those ratios that are used to analyze the companys shares performance on the market. It indicates the shareholders perception of the companys management. They derive their market input by analyzing internal performance with the market prices of the companys shares. They show the level of confidence that the public has towards a companys management team. The financial ratio practical to this case is the price earnings ratio which indicates the earnings attributable to the shareholders at market prices. It is calculated by dividing the market price of the share by the earnings per share which is calculated by dividing the net earnings of the company by the total number of shares outstanding.

Earnings per Share (EPS) = Net Income Outstanding shares

Price Earnings Ratio = Market Price per Share Earnings per share.

Price Earnings Ratio 2015 = $81.13 ($7,769,000,000.00 839,888,661) = 9.30

Price Earnings Ratio 2014 = $86.06 ($1,759,000,000.00 839,88...

Cite this page

Finance Essay Sample: Introduction to Financial Analysis. (2019, Dec 06). Retrieved from https://speedypaper.net/essays/introduction-to-financial-analysis

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- ESL Lesson Plan - Free Essay on English Teaching

- Free Essay on the Place of English in the Chinese Education System

- Free Essay on the Book God's Own Scientists: Creationists in a Secular Age

- Free Essay Example on Social Vulnerability

- Free Paper Sample on Turbomachinery

- Hashtag Activism Essay Example

- Free Paper with a Pharmacist's Resume Example

Popular categories