| Type of paper: | Essay |

| Categories: | Financial analysis |

| Pages: | 2 |

| Wordcount: | 472 words |

Thank you for giving us the appropriate opportunity to work with your school. As requested, our company did an evaluation of your financial reporting to find out the performance of your financial statements. After performing our analysis a recommendations is going to be given for the next move that Gabel School can take.

From the analysis of financial report it is found out that:

The net assets to date of the school is positive an indication that the school is utilizing its available resources. The board has $374,224.00 as designated amount, this amount is to be used by the board for specific purposes.

Currently the school do not have funds that are restricted for the use to indicate the liquidity of the school. The total liabilities that are owed to the school is as low of 900,349.03 and indication that the school has been paying its debts in advance.

The net income of the school has a negative value an indication that the school has been engaging in a lot of operating activities.

The cash at the end of the financing period is less than the cash that the school had at the beginning of the year.

The expenses that are incurred by the school is at a record high of $3,051,155.78. The net income is record low of $454.76.

Depreciation of fixed assets is costing the school a lot pf money to a tune of 2,974,334.71.

Asset base of the school is stable at a value of 5,558,960.85 a value that is more than the current liabilities of currently.

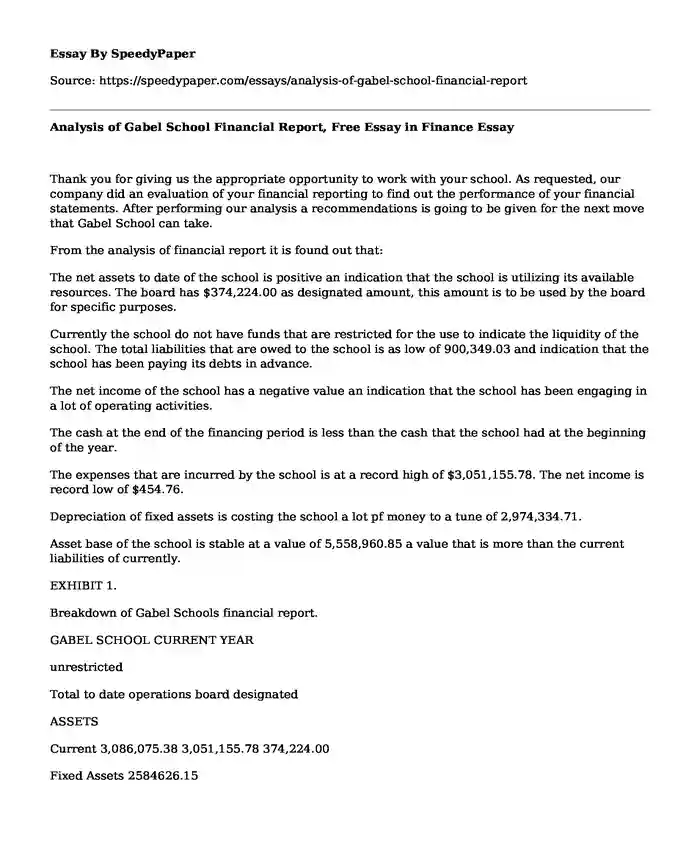

EXHIBIT 1.

Breakdown of Gabel Schools financial report.

GABEL SCHOOL CURRENT YEAR

unrestricted

Total to date operations board designated

ASSETS

Current 3,086,075.38 3,051,155.78 374,224.00

Fixed Assets 2584626.15

Other assets 641,019.57

Long term assets 0

TOTAL ASSETS 6,311,721.10

LIABILITIES

Current liabilities 696,846.59

long term liabilities 203,502.44

TOTAL LIABILITIES 900,349.03

NET ASSETS 5,411,372.07

Unrestricted 2347282.17

Undesignated

Board designated

PPE

Temporarily restricted

Permanently restricted

TOTAL NET ASSETS 7,758,654.24

TOTAL LIABILITIES & NET ASSETS 6311,721.10 3,051,155.78 374,224.00

Conclusion and Recommendations

Basing on the analysis done on the school financial reporting the school should just make an improvement to its financial performance.

The school need to review its credit period that they allow their suppliers. From the above exhibit it evident that the school uses its resources to pay their suppliers in time a move that is hindering its net income position.

The net income of the school is negative, this is an indication that the school is engaging in a lot of operating activities such as loans on vans. It is recommended for the school to revisit their activities and develop a schedule whereby they will finance projects one after the other and not many projects at the same time.

The school should come up with a budgeting technique that will help to cut expenses. The school is spending a lot of money to administer its daily running. The board should consider cutting administration expense by a quarter.

Cite this page

Analysis of Gabel School Financial Report, Free Essay in Finance. (2019, Aug 16). Retrieved from https://speedypaper.net/essays/analysis-of-gabel-school-financial-report

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Sample on Dabbawala Organization

- Leader Definition Essay Samples

- Free Essay in Education Management: Faculty Layoffs Ranking

- Team Communication and Problem Solving, Free Essay in HRM

- Topic #1: The Impact of Globalization on Cross-Cultural Communication

- Essay Sample on John Locke's View on Power and Government

- Free Essay: Analysis of Emerson's Nature Essay

Popular categories